- The Stock whisperer's Newsletter

- Posts

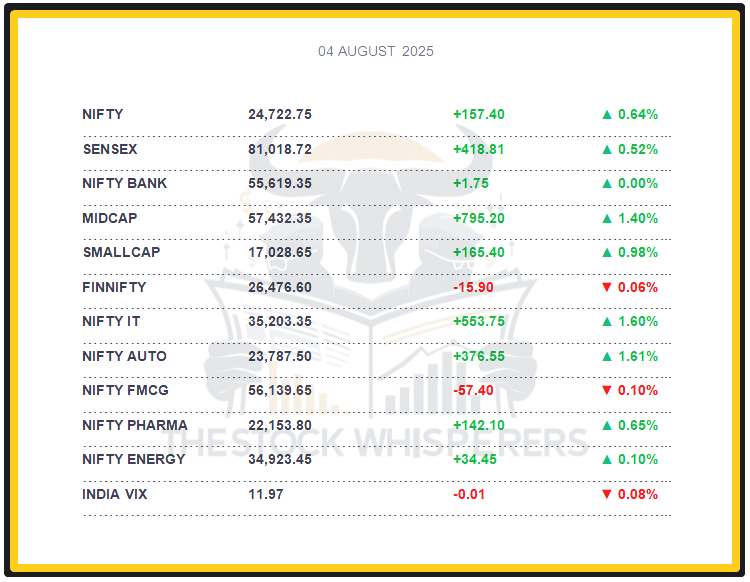

- Sensex, Nifty Rise 0.64% Above 24,700 on Broad-Based Gains

Sensex, Nifty Rise 0.64% Above 24,700 on Broad-Based Gains

📰Daily Market Wrap-Up by Stock Whisperers- August 4, 2025

August 4, 2025

📈 Market Overview:

Market Overview

Summary of the Day's Market Performance

The Sensex rose 418.81 points (+0.52%) to close at 81,018.72, marking a strong session.

The Nifty gained 157.40 points (+0.64%) to 24,722.75, holding above 24,700.

Midcap rose 1%, and Smallcap added 0.7%, reflecting broad market strength.

All sectoral indices ended in the green, with PSU Bank, Pharma, Realty, IT, Metal, Telecom, Media, Consumer Durables, and Auto up 0.5-2.5%.

💸 Market Transactions:

Foreign Institutional Investors (FII): Sold ₹2,566.51 crore

Domestic Institutional Investors (DII): Bought ₹4,386.29 crore

DII inflows drove the rally, offsetting FII outflows amid positive domestic cues.

📊📑 Important Observations and Market Sentiments: Editor Special

The market edged higher, supported by strong metal and auto sector performance, fueled by a weakening US dollar, robust auto sales, and encouraging Q1 FY26 results from automakers. Consumption-driven companies benefited from a rebound in volume demand, boosting investor interest.

Rising US unemployment and slower job creation heightened expectations of a Fed rate cut, though high US tariffs (e.g., 25% on steel) remain a cautionary factor. Domestic resilience was underpinned by the RBI’s 6.00% repo rate, a better monsoon, and strong Q1 GDP (7.2% from the June context).

Analysts expect Nifty to consolidate around 24,700–25,000, with support at 24,500—focus on US Fed policy and Q1 earnings momentum.

❓ DO YOU KNOW?

July 2025 auto sales data showed a 12% YoY increase, the highest growth in 18 months, driven by festive season anticipation and rural demand recovery.

📰Stock News:

Key Stock Movements and News

Top Gainers: Hero MotoCorp, Tata Steel, Bharat Electronics, Adani Ports, and JSW Steel

Top Losers: Power Grid Corp, HDFC Bank, ONGC, ICICI Bank, and Apollo Hospitals

Tata Steel surged 2%, a top Nifty gainer, after a 75.3% YoY Q1 FY26 net profit rise to ₹918.6 crore.

Hero MotoCorp rose up to 3% on strong July sales and positive Q1 FY26 earnings, boosting auto sentiment.

TVS Motor gained up to 3% on robust July sales and strong Q1 FY26 auto performance.

Mahindra & Mahindra (M&M) rose up to 3% on strong July auto sales and positive Q1 FY26 results.

MCX jumped 5% after an 83% YoY Q1 FY26 PAT increase and a 1:5 stock split announcement.

Aditya Birla Capital traded flat after a 10.03% YoY Q1 FY26 profit rise to ₹835.08 crore, despite a 3.42% sequential decline.

Hyundai Motor India traded flat as it went ex-dividend for a ₹21/share dividend.

Your Weekly Stock Markets Rundown: Markets Brace for Volatility Amid Trade and Earnings Focus

August 4-8, 2025

Earnings Season: Over 128 companies, including DLF, Adani Ports, and Bharti Airtel, will report Q1 FY26 results, with analysts noting mixed performances. Trent and Titan are among those to watch for consumer demand trends.

Trade Tensions: The August 1 US tariff deadline saw Trump extend talks with the EU and Canada, with a 50-50 chance of an EU deal. India-US negotiations are postponed to mid-August, keeping tariff risks alive, though domestic demand may cushion the impact.

US Data Impact: Weak July jobs data (expected unemployment at 4.2%) and non-farm payrolls on August 8 could influence Fed rate cut expectations, with a 75% probability of a 25-bps cut in September per market pricing.

Monsoon and Economy: A strong monsoon (90% of normal rainfall so far) supports rural demand, potentially boosting auto and FMCG stocks, while industrial production data due later will clarify manufacturing trends.

Technical Outlook: Nifty’s support at 24,300 and resistance at 24,900 suggest consolidation, with a break below 24,300 risking further downside to 24,000, amid F&O expiry volatility.

👀Stocks to Focus:

Tata Steel: Metal sector strength to monitor.

Hero MotoCorp: Auto sales momentum to watch.

MCX: Stock split impact to observe.

📝Summary:

Indian markets rose 0.64%, with the Nifty at 24,722, driven by gains in the metal and auto sectors amid a weaker US dollar and strong Q1 results. DII buying offsets FII outflows, though US tariffs pose risks. Broad sectoral gains signal optimism—focus on Fed rate cut expectations!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.