- The Stock whisperer's Newsletter

- Posts

- Nifty Nears 24,900 as IT Leads Rally; Fed Cut Hopes and Global Cues Lift Sentiment

Nifty Nears 24,900 as IT Leads Rally; Fed Cut Hopes and Global Cues Lift Sentiment

📰Daily Market Wrap-Up by Stock Whisperers- September 09, 2025

September 09, 2025

📈 Market Overview:

Market Overview

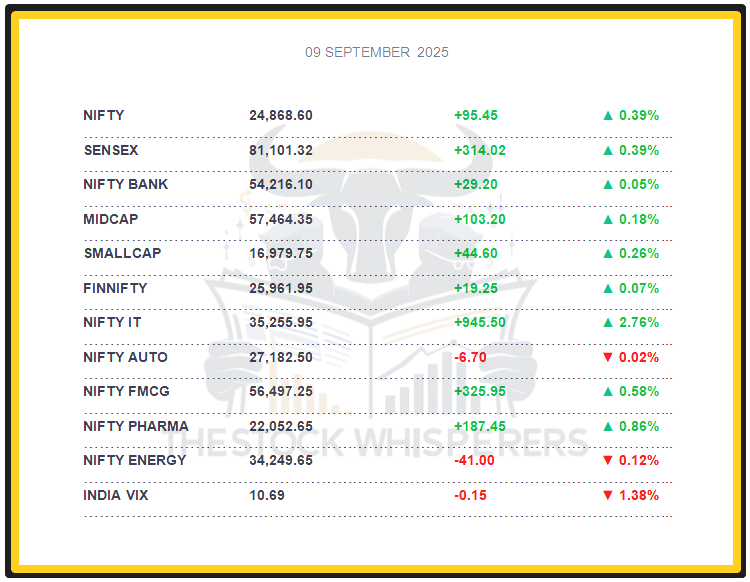

Summary of the Day's Market Performance

The Sensex rose 314.02 points (+0.39%) to close at 81,101.32, ending on a strong note.

The Nifty gained 95.45 points (+0.39%) to 24,868.60, nearing 24,900.

Midcap and Smallcap indices rose 0.2% each, showing modest broader market gains.

IT index surged 2.8%, with Pharma and FMCG up 0.5% each, while Oil & Gas and Realty fell 0.3% each.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹2,050.46 crore

Domestic Institutional Investors (DII): Bought ₹83.08 crore

FII inflows, supported by minimal DII buying, drove the day’s gains.

📊📑 Important Observations and Market Sentiments: Editor Special

The domestic market edged higher, lifted by positive global cues, with IT stocks rebounding on Infosys’s proposed buyback despite headwinds. Auto stocks faced profit booking after recent GST 2.0 gains (effective September 22), while sentiment remains range-bound amid global trade uncertainties (25% US tariffs on steel/aluminum).

Rising Fed rate cut prospects, backed by soft U.S. jobs data, and supportive domestic macros (potential RBI rate cut, robust monsoon) bolster short-term optimism. Analysts expect Nifty to hover around 24,800–25,000, with support at 24,700—watch Fed policy and trade talks.

❓ DO YOU KNOW?

Infosys’s proposed buyback, to be discussed on September 11, could involve up to ₹10,000 crore, marking its largest since 2017, boosting IT sector sentiment.

📰Stock News:

Key Stock Movements and News

Top Gainers: Infosys, Dr Reddy's Labs, Wipro, Tech Mahindra, and Adani Ports

Top Losers: Eternal, Trent, Jio Financial, Tata Motors, and Titan Company

Infosys surged 4-5% on a proposed share buyback announcement for its September 11 board meeting, leading Nifty 50 gainers.

TCS gained, supported by IT sector recovery.

Voltamp Transformers dropped 3.53% to ₹7,503 after a promoter offloaded a 7.8% stake for ₹600 crore, hitting a four-session downtrend.

Sumitomo Mitsui is likely to sell its 1.65% stake in Kotak Mahindra Bank for ₹6,000 crore via block deals.

Amanta Healthcare debuted with modest 10% gains, reflecting pharma sector confidence.

Bikaji Foods’ managing director was summoned by the ED in a PMLA probe, but the company clarified no financial impact.

Dev Accelerator Ltd’s IPO opens September 10 with a ₹56-61 price band, targeting ₹143 crore.

Markets Eye 25,000 Amid GST Boost and Global Rate-Cut Hopes; CPI, ECB in Focus This Week

Weekly Stock Markets Rundown: September 08-12, 2025

The week of September 8-12, 2025, follows gains with Sensex at 80,710.76 and Nifty at 24,741, driven by GST levy reductions favoring autos and metals. Consolidation expected in 24,500-25,000 (Nifty), with volatility from ECB rate decision (Sep 10), US CPI (Sep 11), and India CPI (Sep 12). FII outflows persist, but DII support aids stability; trade truce hopes and exemptions mitigate tariff risks. Focus on infrastructure, metals, banking, and autos for opportunities amid global easing signals.

👀Stocks to Focus:

Infosys: Buyback impact to monitor.

Tata Motors: Auto profit-taking to watch.

Amanta Healthcare: IPO debut to observe.

📝Summary:

Indian markets rose 0.39%, with Nifty at 24,868, driven by IT rebound and global Fed cut hopes. Pharma and FMCG gained, while Auto faced a sell-off. FII buying lifted sentiment—focus on Fed policy and Infosys buyback!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.