- The Stock whisperer's Newsletter

- Posts

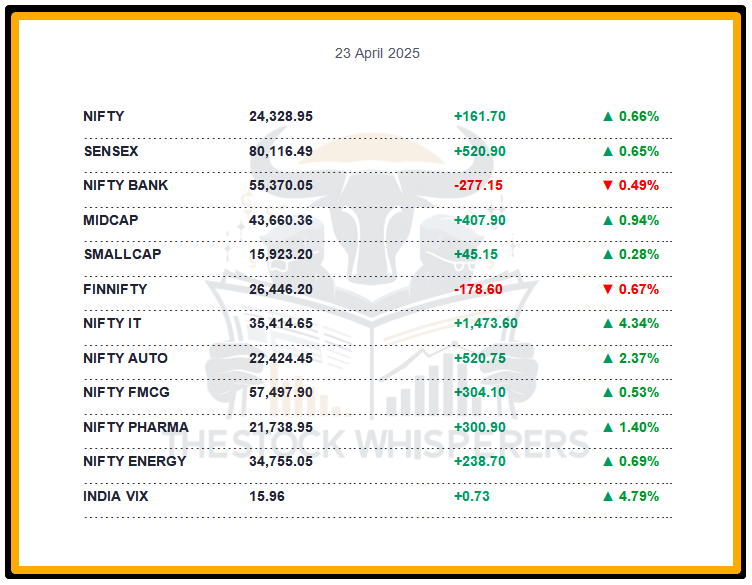

- 🚀 Nifty Hits 24,300! IT Ignites the Rally, Auto Accelerates, But PSU Banks Take a Pit Stop 💻🚗💥

🚀 Nifty Hits 24,300! IT Ignites the Rally, Auto Accelerates, But PSU Banks Take a Pit Stop 💻🚗💥

📰Daily Market Wrap-Up by Stock Whisperers-April 23

23-April-2025

📈 Market Overview:

Summary of the Day's Market Performance

Market Overview

The Sensex rose 520.90 points (+0.65%) to close at 80,116.49 in a positive session.

The Nifty gained 161.70 points (+0.67%) to 24,328.95, holding above 24,300.

Midcap rose 1%, while Smallcap added 0.2%, showing mixed broader market gains.

IT index jumped 4% and Auto added over 2%, while PSU Bank and Consumer Durables fell 0.5-1%.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹3,332.93 crore

Domestic Institutional Investors (DII): Sold ₹1,234.46 crore

Strong FII inflows supported the rally, despite DII profit-taking.

📊📑 Important Observations and Market Sentiments: Editor Special

The market sustained its upward momentum, driven by strong IT Q4 results (e.g., HCL Tech) and optimistic guidance, with the Nifty IT index leading gains. A rally in US tech stocks and easing US-China trade tensions (post-245% tariffs on Chinese goods) bolstered global sentiment.

Profit booking hit financials after their recent rally, while mixed Q4 earnings and rising crude prices (exact levels pending) hint at near-term consolidation. Domestic resilience, backed by the RBI’s 6.00% repo rate and falling inflation, continues to support sentiment.

Investors eye potential profit-taking after the market’s outperformance, with a focus on upcoming Q4 results and global trade developments.

❓ DO YOU KNOW?

The Nifty IT index’s 4% gain today marks its strongest single-day rise since November 2024, fueled by a recovery in global tech sentiment and short covering.

📰Stock News:

Key Stock Movements and News

Top Gainers: HCL Technologies, Tech Mahindra, Tata Motors, Wipro, and Infosys

Top Losers: HDFC Bank, Kotak Mahindra Bank, Axis Bank, SBI, and Grasim Industries

HCL Tech surged 5% after strong Q4 FY25 results, driving the Nifty IT index’s 4% gain.

Ambuja Cements gained focus after completing a 46.66% stake acquisition in Orient Cement.

Suzlon Energy rose on a 378 MW order win from NTPC Green, despite a 1.11% dip on April 22.

IDBI Bank fell 3% intraday after announcing a board meeting on April 28 for Q4 results and dividend discussion.

Power Finance Corporation dropped over 3% due to ₹307 crore pending dues from Gensol Engineering.

Niva Bupa rallied 11% as Motilal Oswal initiated coverage with a 29% upside.

AU Small Finance Bank gained 6% on robust Q4 profit growth.

Schaeffler India declined 1.46% to ₹3,259.80 after profit-taking (intraday low ₹3,214).

Prestige Estates Projects rose 1.35% to ₹1,321.80 with high trading volume, signaling realty interest.

Your Weekly Stock Markets Rundown: 🌍 Trade Turmoil Meets Monsoon Hope as Market Eyes Earnings & Rate Cuts

April 21-25, 2025

The week of April 21-25, 2025, unfolds amid a chaotic trade war between the US and China, testing global supply chains and market resilience. India’s Q4 FY25 earnings season progresses with key IT and financial results, following TCS’s cautious start, while easing inflation and a promising monsoon forecast bolster hopes for RBI rate cuts. However, FII volatility and rising US jobless claims temper optimism. Investors will watch PMI data, loan growth, and consumer confidence figures for direction, with opportunities in IT, consumer goods, and financial stocks amidst the uncertainty.

👀Stocks to Focus:

HCL Tech: Strong Q4 could sustain IT momentum.

Niva Bupa: Brokerage coverage signals upside.

📝Summary:

Indian markets rose 0.7%, with Nifty above 24,300, led by IT (+4%) and Auto amid strong Q4 results and global tech rally. FII buying offset DII selling, though financials saw profit booking. Easing trade tensions and domestic cues support gains, but crude upticks hint at consolidation—watch earnings!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.