- The Stock whisperer's Newsletter

- Posts

- Nifty Crosses 25,000 as Markets Shake Off US Tariff Shock; Reforms & Trade Talk Hopes Lift Sentiment

Nifty Crosses 25,000 as Markets Shake Off US Tariff Shock; Reforms & Trade Talk Hopes Lift Sentiment

📰Daily Market Wrap-Up by Stock Whisperers- September 11, 2025

September 11, 2025

📈 Market Overview:

Market Overview

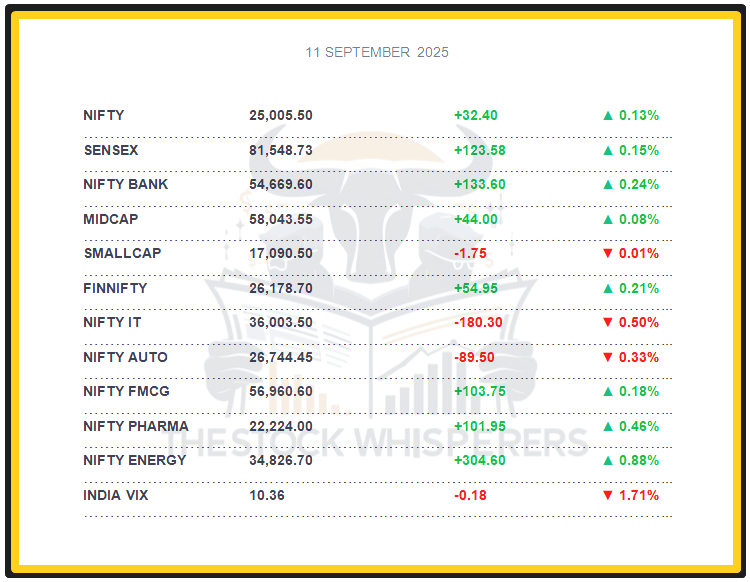

Summary of the Day's Market Performance

The Sensex rose 123.58 points (+0.15%) to close at 81,548.73, ending on a positive note.

The Nifty gained 32.40 points (+0.13%) to 25,005.50, crossing the 25,000 threshold.

Midcap and Smallcap indices ended flat, showing stability in broader markets.

Energy, PSU Bank, Pharma, Oil & Gas, and Media rose 0.5-1%, while IT declined 0.5% and Auto shed 0.3%.

💸 Market Transactions:

Foreign Institutional Investors (FII): Sold ₹3,472.37 crore

Domestic Institutional Investors (DII): Bought ₹4,045.54 crore

Strong DII inflows drove the recovery, offsetting significant FII outflows.

📊📑 Important Observations and Market Sentiments: Editor Special

The Nifty50 closed above 25,000, recovering from an intraday drop to 24,400 due to a surprise 50% US tariff on India. The rebound reflects expectations of limited domestic impact, a robust Indian government response, and domestic reforms like GST rationalization (effective September 22), mitigating trade repercussions.

Positive US signals to resume trade talks bolstered sentiment, though global uncertainties (Russia-Ukraine tensions) persist. Fed rate cut hopes (post-soft U.S. jobs data) and supportive macros (potential RBI rate cut, monsoon benefits) sustain optimism, though range-bound trading is likely.

Analysts expect Nifty to consolidate around 25,000–25,300, with support at 24,900—monitor trade negotiations and Fed policy.

❓ DO YOU KNOW?

The US’s unexpected 50% tariff, effective today, marks a sharp escalation from the prior 25% on steel/aluminum, prompting India to propose retaliatory tariffs and expedite trade talks.

📰Stock News:

Key Stock Movements and News

Top Gainers: Adani Enterprises, Shriram Finance, NTPC, Axis Bank, and Power Grid

Top Losers: Bajaj Auto, Infosys, SBI Life Insurance, Wipro, and Titan Company

Infosys fell 1.41% to ₹1,511.00 ahead of its September 11 board meeting on share buyback plans, dragging IT.

Aurobindo Pharma surged 4.5% on reports of a $4.8 billion GTCR deal to acquire Zentiva, boosting pharma sentiment.

Reliance Industries advanced 0.38% to ₹1,382.10 after launching its new AI unit, despite energy volatility.

Adani Power gained 1.87% to ₹646.30 after Nagpur coal mine project approval.

Reliance Communications fell after a ₹400 crore loan fraud show-cause notice from Central Bank of India.

Adani Ports traded flat after acquiring Dependenciab Logistics, with stable port sentiment.

Biocon traded flat after opening a new US facility, maintaining biotech interest.

Dr Reddy’s Laboratories traded flat after acquiring STUGERON, with cautious pharma sentiment.

Eicher Motors traded flat after extending GST benefits, supporting auto stability.

Rail Vikas Nigam Ltd (RVNL) traded flat after winning a ₹169.5 crore bid, with steady railway sentiment.

Dev Accelerator Ltd’s IPO subscription continued, drawing real estate focus.

Urban Company shares were in focus amid IPO developments, lifting service sector sentiment.

Markets Eye 25,000 Amid GST Boost and Global Rate-Cut Hopes; CPI, ECB in Focus This Week

Weekly Stock Markets Rundown: September 08-12, 2025

The week of September 8-12, 2025, follows gains with Sensex at 80,710.76 and Nifty at 24,741, driven by GST levy reductions favoring autos and metals. Consolidation expected in 24,500-25,000 (Nifty), with volatility from ECB rate decision (Sep 10), US CPI (Sep 11), and India CPI (Sep 12). FII outflows persist, but DII support aids stability; trade truce hopes and exemptions mitigate tariff risks. Focus on infrastructure, metals, banking, and autos for opportunities amid global easing signals.

👀Stocks to Focus:

Infosys: Buyback outcome to monitor.

Aurobindo Pharma: Deal impact to watch.

Adani Power: Project progress to observe.

📝Summary:

Indian markets rose 0.13%, with Nifty at 25,005, crossing 25,000 despite a 50% US tariff shock. Energy and Pharma gained, while IT and Auto lagged. DII buying offsets FII outflows—focus on trade talks and Fed rate cut!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.