- The Stock whisperer's Newsletter

- Posts

- Markets Slip on Profit Booking; IT Shines, Investors Turn Cautious Ahead of Q2 Earnings

Markets Slip on Profit Booking; IT Shines, Investors Turn Cautious Ahead of Q2 Earnings

📰Daily Market Wrap-Up by Stock Whisperers- October 08, 2025

October 08, 2025

📈 Market Overview:

Market Overview

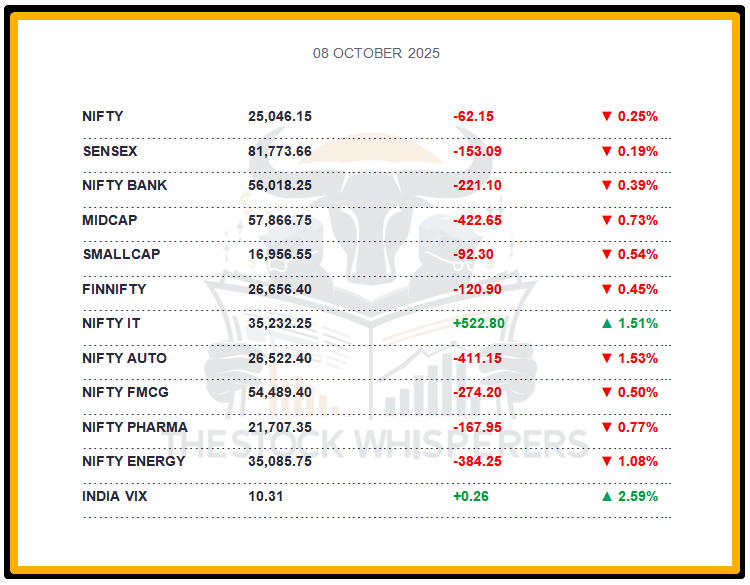

Summary of the Day's Market Performance

The Sensex fell 153.09 points (-0.19%) to close at 81,773.66, ending a volatile session lower.

The Nifty dropped 62.15 points (-0.25%) to 25,046.15, reflecting caution after a rally.

Midcap index shed 0.7%, and Smallcap indices declined 0.4%, showing broader market weakness.

Except Consumer Durables and IT, all other sectoral indices ended in the red, with Realty, Telecom, Pharma, Oil & Gas, Media, PSU Bank, and Auto down 0.3-2%.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹81.28 crore

Domestic Institutional Investors (DII): Bought ₹329.96 crore

Modest FII and DII inflows couldn’t prevent profit booking after recent gains.

📊📑 Important Observations and Market Sentiments: Editor Special

National indices saw volatility, tempered by profit booking after a sharp rally, with investors cautious ahead of the Q2 earnings season. IT stocks outperformed on resilient demand and valuations, while Auto, Banking, and FMCG faced selling pressure.

A U.S. government shutdown and gold hitting a historical high ($2,675/oz) signaled risk aversion, while attention shifts to the September FOMC minutes for Fed insights. Domestic focus remains on earnings, macro data, and festive season demand, with support at 24,900.

❓ DO YOU KNOW?

The U.S. shutdown, effective today, marks the first since 2018, potentially delaying $6 billion in aid to Ukraine, impacting global markets and gold prices.

📰Stock News:

Key Stock Movements and News

Top Gainers: Titan Company, Infosys, TCS, Tech Mahindra, and Max Healthcare

Top Losers: Tata Motors, UltraTech Cement, Jio Financial, ONGC, and Trent

DreamFolks shares hit a 5% upper circuit after launching exclusive club memberships and a premium wallet, despite a 71% YTD drop.

Saatvik Green Energy rose on solar module orders worth over ₹700 crore, reinforcing its position as a top PV module maker.

Eimco Elecon hit a 20% upper circuit after Vijay Kedia bought a ₹11 crore stake, up 619% in five years.

Samvardhana Motherson fell 2% after BMW cut its 2025 earnings forecast, impacting 5% of its 2024 revenue.

SBI Cards rose 2.5% on the new RBI credit loss framework, reducing risk-weighted assets to 75% from 150%, releasing 450 bps of capital per Macquarie.

Anant Raj dropped 4% as it launched a QIP at ₹695.83 to raise up to ₹1,100 crore.

Brightcom, IFCI, and Jai Corp rose up to 11% on a circuit change announcement, with Brightcom gaining 15.79% to ₹15.11.

Titan stock jumped 4% on a 20% Q2 growth in consumer businesses.

Advance Agrolife settled 8% higher on debut (market cap ₹726.43 crore).

Tata Motors fell 1% as JLR’s Q2 sales dropped due to a cyber incident and model phase-out.

Nifty Targets 25,400 Amid Q2 Earnings Surge and Volatility Alerts

Weekly Stock Markets Rundown: 06-10 October 2025

The week of October 6-10, 2025, starts with Nifty at 24,894.25 and Sensex up 0.28%, poised for upside to 25,400 amid Q2 earnings and IPOs, but volatility peaks on October 6,7,9. US Powell speech, jobless claims, and Eurozone PMI will guide global flows, while FII outflows persist against DII support. Nifty's bullish EMAs hold above 24,800 support; focus on IT, banking, renewables, and cement for gains in a data-heavy stretch.

👀Stocks to Focus:

Titan Company: Q2 growth to monitor.

Saatvik Green Energy: Order impact to watch.

Tata Motors: JLR recovery to observe.

📝Summary:

Indian markets fell 0.25%, with Nifty at 25,046, as profit booking hit after a rally. IT and Consumer Durables gained, while Auto and PSU Banks lagged. Modest FII/DII buying softened the decline—focus on earnings and FOMC minutes!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.