- The Stock whisperer's Newsletter

- Posts

- Markets Rebound as Fed’s Dovish Signal Sparks Global Cheer and Realty Stocks Shine!

Markets Rebound as Fed’s Dovish Signal Sparks Global Cheer and Realty Stocks Shine!

📰Daily Market Wrap-Up by Stock Whisperers- October 15, 2025

October 15, 2025

📈 Market Overview:

Market Overview

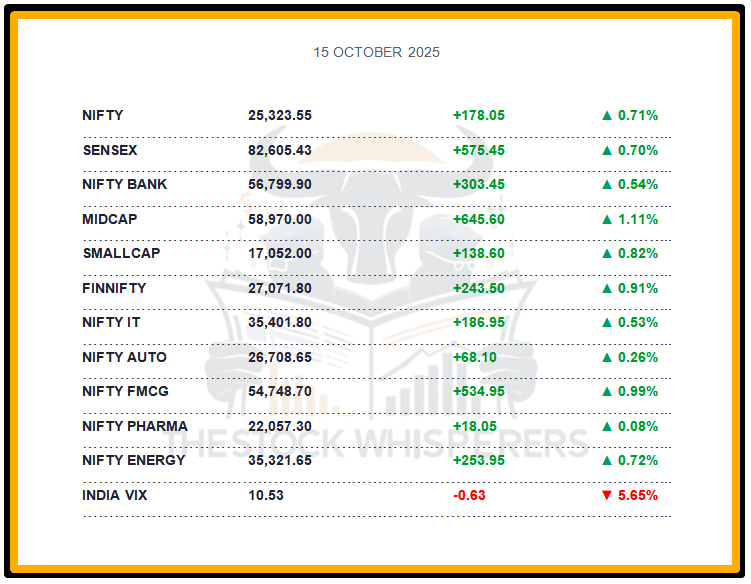

Summary of the Day's Market Performance

The Sensex gained 575.45 points (+0.70%) to close at 82,605.43, rebounding after two days of losses.

The Nifty rose 178.05 points (+0.71%) to 25,323.55, climbing above 25,300.

Midcap index added 1%, and Smallcap index jumped 0.7%, reflecting broad market strength.

All sectoral indices ended in the green, with Realty up 3%, and Power, Consumer Durables, PSU Bank, Metal, and Telecom up 1-2%.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹68.64 crore

Domestic Institutional Investors (DII): Bought ₹4,650.08 crore

Strong DII inflows, supported by modest FII buying, drove the day’s rally.

📊📑 Important Observations and Market Sentiments: Editor Special

The national market rallied after two days of selling, spurred by dovish Fed comments on rates and a potential quantitative tightening pause, boosting global sentiment. A declining U.S. 10-year yield and a stronger rupee (84.10 from 84.15) signaled FII momentum shifting to emerging markets like India.

Realty outperformed due to easing interest rates and attractive valuations, while IT and Metal gained on global cues. Q2 FY26 earnings momentum and festive demand (GST 2.0 effective September 22) support optimism, though U.S.-China trade tensions ($18 billion tariffs) linger. Analysts expect Nifty to consolidate around 25,200–25,400, with support at 25,100—watch Q2 results and festive trends.

❓ DO YOU KNOW?

Gold hit a new lifetime high of $4,050/oz today, driven by geopolitical tensions and U.S. rate cut expectations, boosting gold financiers like IIFL and Manappuram.

📰Stock News:

Key Stock Movements and News

Top Gainers: Bajaj Finserv, Bajaj Finance, Trent, Nestle India, and Asian Paints

Top Losers: Infosys, Tata Motors, Bajaj Auto, Tech Mahindra, and Axis Bank

Infosys, Cognizant, Accenture, and LTIMindtree invested in Oracle’s $1.5 billion AI Data Platform, training 8,000 practitioners for AI use cases.

MTAR Tech, BEML, and HAL rose up to 4% on reports of increased FY26 defense spending.

IIFL Finance and Manappuram gained up to 5% as gold prices hit record highs, enhancing collateral value for loans.

Hyundai Motor India rose 2.5% after unveiling a ₹45,000 crore investment plan and naming a new CEO, targeting ₹1 lakh crore revenue by FY30.

Urban Company jumped 8%, snapping a five-session losing streak as its shareholder lock-in period nears its end.

Ola Electric hit a 5% upper circuit ahead of its ‘Ola Shakti’ non-vehicle product launch tomorrow.

ICICI Lombard surged 8% and Thyrocare rallied 17% after strong Q2 results (18% and 80% profit growth, respectively).

Prosus acquired a 5.33% stake in ixigo for ₹620-660 crore, raising its holding to ~15%.

Bulls Steady Ahead of Earnings Season, Inflation Data, and Trump vs China Trade Tensions!

Weekly Stock Markets Rundown: 13-17 October 2025

The week of October 13-17, 2025, builds on Nifty's close at 25,285.35 and Sensex at 82,500.82, with Q2 earnings (HCL Tech, Reliance) and inflation data (WPI Oct 13, CPI Oct 16) in the spotlight. US CPI and jobs report add global volatility, while FII buying signals easing pressures. Nifty eyes 25,400 upside above 25,000 support; focus on IT, diversified, and insurance stocks amid RBI cut hopes and trade progress.

👀Stocks to Focus:

ICICI Lombard: Q2 profit growth to monitor.

Ola Electric: Non-vehicle product launch to watch.

Hyundai Motor India: Investment plan impact to observe.

📝Summary:

Indian markets rose 0.71%, with Nifty above 25,323, led by Realty and PSU Banks on dovish Fed cues and gold’s rally. DII/FII inflows fueled gains, while IT lagged—focus on Q2 earnings and festive demand!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.