- The Stock whisperer's Newsletter

- Posts

- ⚠️ Markets Rattle as Geo-Tensions Spike! Nifty Near 24K, Small & Midcaps Take a Beating 💣📉

⚠️ Markets Rattle as Geo-Tensions Spike! Nifty Near 24K, Small & Midcaps Take a Beating 💣📉

📰Daily Market Wrap-Up by Stock Whisperers-April 25

25-April-2025

📈 Market Overview:

Summary of the Day's Market Performance

Market Overview

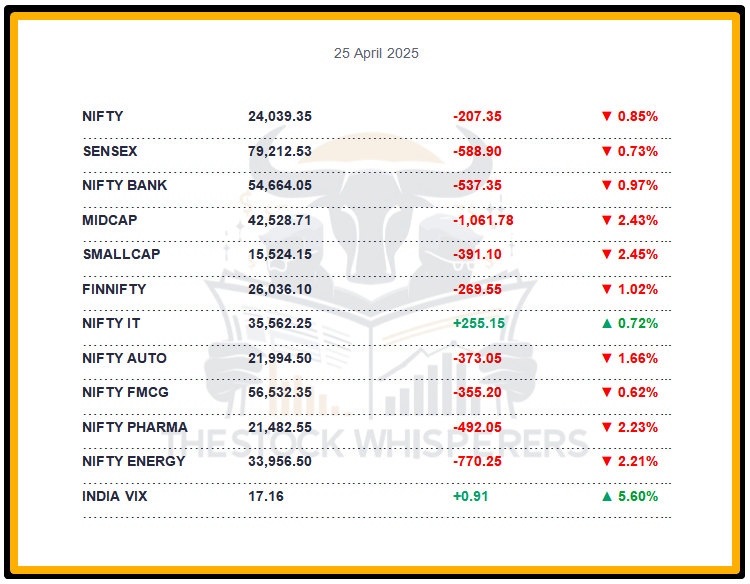

The Sensex fell 588.90 points (-0.74%) to close at 79,212.53, marking a second consecutive decline.

The Nifty dropped 207.35 points (-0.86%) to 24,039.35, slipping around 24,000.

Midcap and Smallcap indices shed 2.5% each, reflecting broader market weakness.

All sectors ended in the red except IT

with Media, Metal, PSU, Telecom, Power, Oil and gas, and Real Estate down 2-3%.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹2,952.33 crore

Domestic Institutional Investors (DII): Bought ₹3,539.85 crore

Robust DII buying countered FII inflows but couldn’t prevent the sell-off amid heightened risks.

📊📑 Important Observations and Market Sentiments: Editor Special

The downturn was triggered by escalating India-Pakistan tensions following the Pahalgam terror attack, leading to retaliatory firing along the Line of Control and India’s suspension of the Indus Water Treaty. This geopolitical risk spooked investors ahead of the weekend.

The volatility index surged 6%, signaling increased fear, with Smallcap and Midcap indices hit hardest due to stretched valuations. IT stocks provided some respite, buoyed by strong Q4 results.

Despite the dip, the market posted a weekly gain of nearly 1%, supported by domestic resilience (RBI’s 6.00% repo rate, low inflation) and global IT momentum, though near-term consolidation looms.

Market This Week

The market posted a nearly 1% weekly gain, marking the second straight week of gains.

Thursday and Friday declines trimmed gains; Nifty Bank is up 0.7%, and the Midcap index is nearly 2%.

❓ DO YOU KNOW?

The India VIX’s 6% jump today is its highest single-day spike since March 2023, reflecting investor panic over the Indus Water Treaty suspension—the first such move since 1960.

📰Stock News:

Key Stock Movements and News

Top Gainers: SBI Life Insurance, Infosys, TCS, Tech Mahindra, and IndusInd Bank

Top Losers: Axis Bank, Adani Enterprises, Shriram Finance, Adani Ports, and Trent

Axis Bank sank 4% despite a 16% YoY Q4 PAT rise to ₹7,599 crore, hit by a weak growth outlook.

Patel Engineering gained 5% after securing ₹2,036 crore in projects, boosting infrastructure sentiment.

IndiGo fell over 3% as Pakistan shut its airspace, impacting operations amid tensions.

Hindustan Zinc rose with a 47% YoY Q4 profit surge to ₹3,003 crore and 20% revenue growth.

Maruti Suzuki dipped 1% as Q4 profit fell 1% YoY to ₹3,911 crore despite a 6% revenue rise.

Yes Bank gained focus after a ₹2,209 crore tax demand for AY 2019-20 was scrapped.

Power Grid Corporation advanced on its 85 MW solar PV plant milestone in Madhya Pradesh.

Muthoot Finance traded ex-dividend (₹26/share interim), drawing payout attention.

Ami Organics traded ex-split (1:2), influencing share price dynamics.

Tech Mahindra rose after a 76% YoY Q4 profit jump to ₹1,167 crore, with a ₹30/share dividend.

Lemon Tree Hotels was recommended as a top buy by Bajaj Broking for its hospitality outlook.

Your Weekly Stock Markets Rundown: 🌍 Trade Turmoil Meets Monsoon Hope as Market Eyes Earnings & Rate Cuts

April 21-25, 2025

The week of April 21-25, 2025, unfolds amid a chaotic trade war between the US and China, testing global supply chains and market resilience. India’s Q4 FY25 earnings season progresses with key IT and financial results, following TCS’s cautious start, while easing inflation and a promising monsoon forecast bolster hopes for RBI rate cuts. However, FII volatility and rising US jobless claims temper optimism. Investors will watch PMI data, loan growth, and consumer confidence figures for direction, with opportunities in IT, consumer goods, and financial stocks amidst the uncertainty.

👀Stocks to Focus:

Tech Mahindra: Strong Q4 may sustain IT gains.

Axis Bank: Weak outlook to watch.

Hindustan Zinc: Profit surge signals upside.

📝Summary:

Indian markets fell 0.9%, with Nifty around 24,000, as India-Pakistan tensions and profit booking triggered a broad sell-off—Midcaps and Smallcaps hit hardest. IT held firm, supported by FII and DII buying, but geopolitical risks and weak FMCG earnings hint at consolidation. Weekly gains persist at 1%—monitor tensions!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.