- The Stock whisperer's Newsletter

- Posts

- "Markets Rally on Fed Cut Hopes and Trade Deal Optimism

"Markets Rally on Fed Cut Hopes and Trade Deal Optimism

📰Daily Market Wrap-Up by Stock Whisperers- September 16, 2025

September 16, 2025

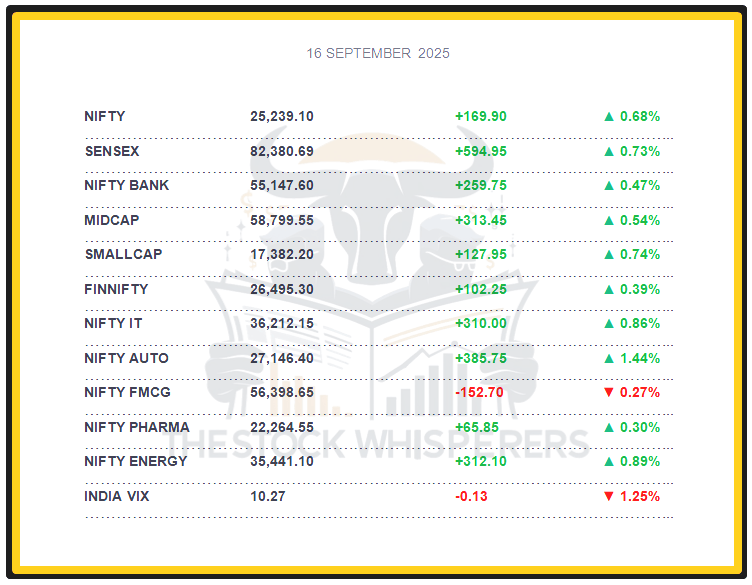

📈 Market Overview:

Market Overview

Summary of the Day's Market Performance

The Sensex rose 594.95 points (+0.73%) to close at 82,380.69, ending on a strong note.

The Nifty gained 169.90 points (+0.68%) to 25,239.10, crossing 25,200.

Midcap and Smallcap indices rose 0.6% each, reflecting broad-based gains.

Auto, Realty, and Telecom added 1% each, with all sectors in the green except FMCG.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹308.32 crore

Domestic Institutional Investors (DII): Bought ₹1,518.73 crore

DII inflows, supported by modest FII buying, fueled the day’s rally.

📊📑 Important Observations and Market Sentiments: Editor Special

The domestic market sustained its recovery, driven by global optimism over a ~25 bps Fed rate cut (expected tomorrow) and renewed India-US trade negotiations (amid a 50% tariff). Auto and consumer durable stocks outperformed ahead of GST 2.0 rollout (September 22) and festive demand.

Strong domestic macros (potential RBI rate cut, monsoon benefits) and upward earnings revisions for H2FY26 support valuations, mitigating downside risks from trade uncertainties. Analysts expect Nifty to consolidate around 25,200–25,500, with support at 25,100—watch Fed policy and trade progress.

❓ DO YOU KNOW?

The Fed’s rate decision tomorrow follows today’s U.S. retail sales data (expected +0.3% MoM), with a 25-bps cut widely anticipated, potentially easing global borrowing costs.

📰Stock News:

Key Stock Movements and News

Top Gainers: JKotak Mahindra Bank, L&T, Maruti Suzuki, Bharti Airtel, and Tata Steel

Top Losers: Shriram Finance, Bajaj Finance, Tata Consumer, Nestle, and Asian Paints

Redington shares hit 20% upper circuit ahead of iPhone 17 sales starting September 19, with heavy volumes boosting sentiment.

IndusInd Bank traded flat after announcing Charu Sachdeva Mathur’s resignation as Head of Digital Banking, effective September 15.

Sigachi Industries surged 15% to ₹43.24, driven by trade optimism, high volumes, and a 10% dividend payout of ₹3.82 crore (record date today).

Indian Life Insurers’ new business premiums rose 6.01% to ₹1,63,461.52 crore in August, lifting insurance sentiment.

Jinkushal Industries set a ₹115-121 price band for its IPO (fresh issue 86.36 lakh shares, OFS 9.6 lakh shares), closing September 29.

ZappFresh IPO (DSM Fresh Food) opened September 26 for expansion and acquisitions, drawing retail interest.

Gold ETFs saw 397 tonnes of inflows in H1 2025, with potential 10-15% price gains if the Fed cuts rates, though outflows pose a risk.

Markets Eye Fed Rate Cut & Trade Deal Boost as Bull Run Stretches Into New Week

Weekly Stock Markets Rundown: September 15-19, 2025

The week of September 15-19, 2025, starts strong after Nifty's 1.51% weekly gain to above 25,100 and Sensex at 81,904.70, fueled by Fed cut anticipation and trade deal buzz. The FOMC decision on September 17 and US jobs data (Sep 19) will be pivotal, alongside India's PMI final and CPI impacts. Nifty's bullish bias persists above 25,000, with support from DIIs despite FII selling. September 18-19 flagged as key dates for reversals; focus on infrastructure, metals, banking, and autos for potential upside amid global easing signals.

👀Stocks to Focus:

Maruti Suzuki: Auto momentum to monitor.

Sigachi Industries: Dividend and trade impact to watch.

Jinkushal Industries: IPO buzz to observe.

📝Summary:

Indian markets rose 0.68%, with Nifty at 25,239, driven by Fed cut expectations and trade talk progress. Auto and Realty gained, while FMCG lagged. DII buying lifted sentiment—focus on Fed decision tomorrow!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.