- The Stock whisperer's Newsletter

- Posts

- Markets Extend Losses as Weak Inflation Data and Q2 Earnings Jitters Trigger Broad Sell-Off!

Markets Extend Losses as Weak Inflation Data and Q2 Earnings Jitters Trigger Broad Sell-Off!

📰Daily Market Wrap-Up by Stock Whisperers- October 14, 2025

October 14, 2025

📈 Market Overview:

Market Overview

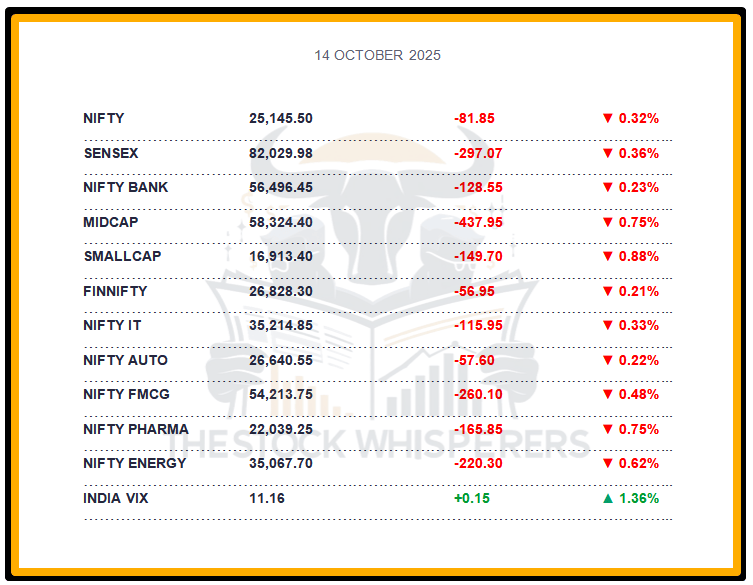

Summary of the Day's Market Performance

The Sensex fell 297.07 points (-0.36%) to close at 82,029.98, ending lower.

The Nifty dropped 81.85 points (-0.32%) to 25,145.50, slipping below 25,200.

Midcap index shed 0.8%, and Smallcap indices fell 0.9%, reflecting broader market weakness.

All sectoral indices ended in the red, with Pharma, Consumer Durables, Metal, Media, and PSU Bank down 1-1.5%.

💸 Market Transactions:

Foreign Institutional Investors (FII): Sold ₹1,508.53 crore

Domestic Institutional Investors (DII): Bought ₹3,661.13 crore

DII buying mitigated losses, but couldn’t counter FII outflows and broad selling.

📊📑 Important Observations and Market Sentiments: Editor Special

The domestic market saw a muted start to Q2 FY26 earnings, with weaker-than-expected inflation data (likely CPI above 5%) raising demand concerns, intensifying profit booking. Mid and small-cap stocks underperformed, while sectoral losses were broad-based.

Despite short-term volatility, medium-term optimism persists, driven by anticipated H2FY26 demand recovery, GST 2.0 benefits (effective September 22), and festive season tailwinds. Global uncertainties, including the U.S. shutdown and U.S.-China trade tensions ($18 billion tariffs), weighed on sentiment. Analysts expect Nifty to consolidate around 25,000–25,200, with support at 24,900—watch earnings and macro data.

❓ DO YOU KNOW?

India’s CPI inflation likely rose to 5.1% in September (from 3.7% in August), per early estimates, signaling demand slowdown concerns ahead of festive spending.

📰Stock News:

Key Stock Movements and News

Top Gainers: Max Healthcare, Apollo Hospitals, Tech Mahindra, Wipro, and ICICI Bank

Top Losers: Dr Reddy's Laboratories, Bajaj Finance, Bharat Electronics, TCS, and Trent

LG Electronics India debuted at ₹1,710.10 on NSE (50% premium over ₹1,140 IPO price), settling at ₹1,682.8 (+48%) after a ₹4 lakh crore subscription.

Cochin Shipyard rose after a 7-session fall, bagging a ₹2,000 crore order for six feeder container vessels from a European client.

Persistent Systems jumped as Q2 profit soared 45% YoY to ₹471.4 crore, beating estimates on margin expansion.

Hindustan Zinc dropped 5% from intraday highs as silver prices fell from record levels, impacting the Vedanta Group firm.

Anant Raj dipped 4% after a ₹1,100 crore QIP at a 4.86% discount (₹662/share), focusing on data center expansion.

Thyrocare gained as Q2 profit jumped 80% to ₹48 crore, announcing a 2:1 bonus issue and ₹7 interim dividend.

Natco Pharma fell 3.5% as the Supreme Court agreed to urgently list Roche’s plea against its Risdiplam launch.

RBL Bank rose 1% after denying reports of Emirates NBD eyeing a ₹15,000 crore majority stake.

Bulls Steady Ahead of Earnings Season, Inflation Data, and Trump vs China Trade Tensions!

Weekly Stock Markets Rundown: 13-17 October 2025

The week of October 13-17, 2025, builds on Nifty's close at 25,285.35 and Sensex at 82,500.82, with Q2 earnings (HCL Tech, Reliance) and inflation data (WPI Oct 13, CPI Oct 16) in the spotlight. US CPI and jobs report add global volatility, while FII buying signals easing pressures. Nifty eyes 25,400 upside above 25,000 support; focus on IT, diversified, and insurance stocks amid RBI cut hopes and trade progress.

👀Stocks to Focus:

Persistent Systems: Q2 profit surge to monitor.

LG Electronics India: Post-listing performance to watch.

Anant Raj: QIP and data center plans to observe.

📝Summary:

Indian markets fell 0.32%, with Nifty at 25,145, as muted Q2 earnings and inflation concerns triggered broad selling. Healthcare and IT showed resilience, while Pharma and Metals lagged. DII buying offsets FII outflows—focus on earnings and festive demand!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.