- The Stock whisperer's Newsletter

- Posts

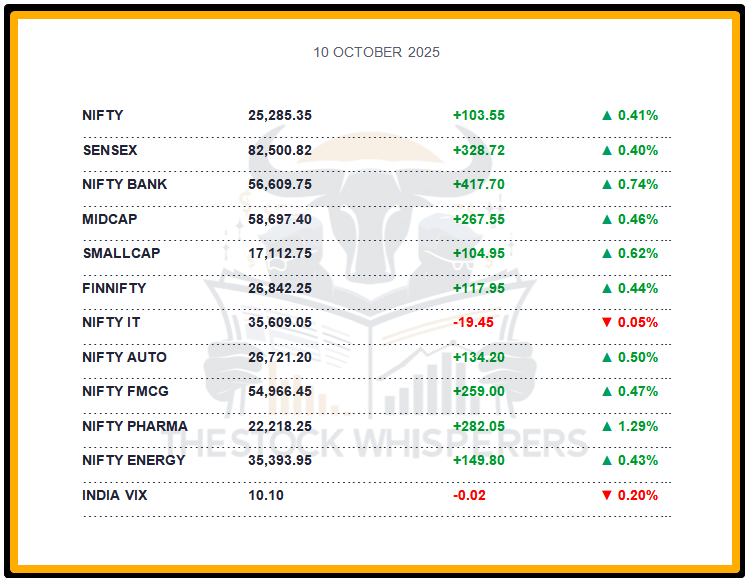

- Markets End the Week on a High; Banking & Pharma Power Nifty Past 25,280 Mark

Markets End the Week on a High; Banking & Pharma Power Nifty Past 25,280 Mark

📰Daily Market Wrap-Up by Stock Whisperers- October 10, 2025

October 10, 2025

📈 Market Overview:

Market Overview

Summary of the Day's Market Performance

The Sensex gained 328.72 points (+0.40%) to close at 82,500.82, ending on a strong note.

The Nifty rose 103.55 points (+0.41%) to 25,285.35, settling around 25,300.

Midcap index rose 0.4%, and Smallcap index gained 0.6%, reflecting broader market strength.

Auto, Bank, Consumer Durables, PSU Bank, Realty, and Pharma added 0.5-1%, while Metal shed 0.8%.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹459.20 crore

Domestic Institutional Investors (DII): Bought ₹1,707.83 crore

FII and DII inflows fueled the day’s rally, supporting market momentum.

📊📑 Important Observations and Market Sentiments: Editor Special

Indian equities rallied, led by banking and pharma stocks, as the government’s move to allow private sector professionals to lead SBI signaled broader PSU reforms for efficiency and governance.

Pharma stocks surged after the U.S. Senate passed the Biosecure Act, cutting biotech ties with Chinese firms and boosting Indian CDMOs. With Q2 FY26 earnings underway, investors eye corporate results for market direction, supported by festive demand and GST 2.0 (effective September 22).

Global cues, including U.S.-India trade talk progress and a stable rupee (84.20), added optimism. Analysts expect Nifty to consolidate around 25,200–25,400, with support at 25,000—watch earnings and trade updates.

❓ DO YOU KNOW?

The U.S. Biosecure Act, passed today, targets Chinese biotech firms like WuXi AppTec, creating opportunities for Indian CDMOs like Divi’s Labs, with potential $2 billion in redirected contracts.

📰Stock News:

Key Stock Movements and News

Top Gainers: Cipla, SBI, Dr Reddy's Labs, Maruti Suzuki, and Adani Ports

Top Losers: Tata Steel, TCS, JSW Steel, Tech Mahindra, and HDFC Life

Natco Pharma jumped 6% after the Delhi HC allowed sales of ‘Risdiplam’ in India, despite a 40% YTD drop.

Divi’s Labs and Laurus Labs rose up to 5% as the U.S. Biosecure Act boosted Indian CDMOs.

Manappuram and Muthoot fell up to 3.5% as gold dipped below $4,000/oz amid easing rate cut hopes.

Man Industries gained 4% after SAT stayed a SEBI order imposing a ₹25 lakh fine and market ban.

SpiceJet surged 7% after adding three new aircraft to its fleet, hitting ₹35.59 intraday.

Textile stocks rallied up to 11% after Trump-Modi trade talks showed ‘good progress,’ boosting export optimism.

TCS announced a new entity to build multiple AI and Sovereign Data Centers in India, including a 1 GW AI datacenter, reinforcing its Q2 growth narrative.

Nifty Targets 25,400 Amid Q2 Earnings Surge and Volatility Alerts

Weekly Stock Markets Rundown: 06-10 October 2025

The week of October 6-10, 2025, starts with Nifty at 24,894.25 and Sensex up 0.28%, poised for upside to 25,400 amid Q2 earnings and IPOs, but volatility peaks on October 6,7,9. US Powell speech, jobless claims, and Eurozone PMI will guide global flows, while FII outflows persist against DII support. Nifty's bullish EMAs hold above 24,800 support; focus on IT, banking, renewables, and cement for gains in a data-heavy stretch.

👀Stocks to Focus:

Natco Pharma: Court ruling impact to monitor.

Divi’s Labs: Biosecure Act benefits to watch.

SpiceJet: Fleet expansion to observe.

📝Summary:

Indian markets rose 0.41%, with Nifty at 25,285, led by banking and pharma on PSU reforms and the U.S. Biosecure Act. FII/DII inflows drove gains, while metals lagged—focus on Q2 earnings and trade talks!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.