- The Stock whisperer's Newsletter

- Posts

- 📉 Markets Dip Again Amid Tariff Tensions; Nifty Ends Below 24,800 💔

📉 Markets Dip Again Amid Tariff Tensions; Nifty Ends Below 24,800 💔

📰Daily Market Wrap-Up by Stock Whisperers-July 31, 2025

July 31, 2025

📈 Market Overview:

Market Overview

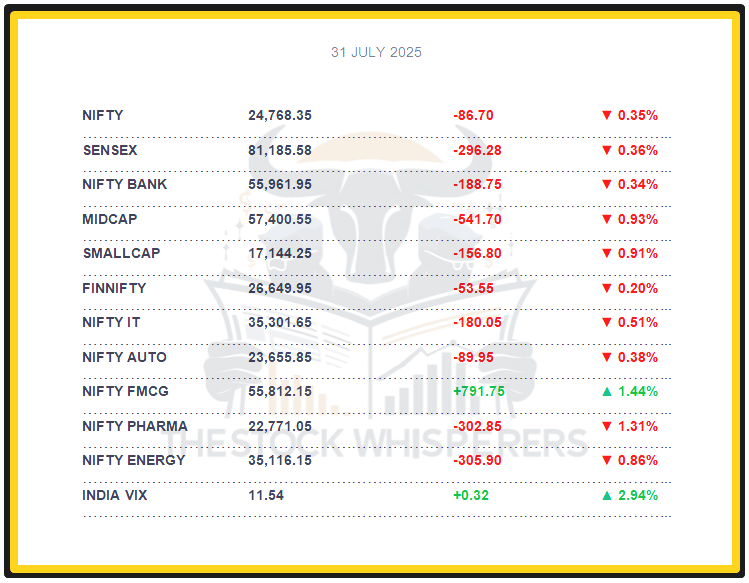

Summary of the Day's Market Performance

The Sensex fell 296.28 points (-0.36%) to close at 81,185.58, marking a second consecutive decline.

The Nifty dropped 86.70 points (-0.35%) to 24,768.35, slipping below 24,800.

Midcap and Smallcap indices shed 0.7% each, reflecting broader market weakness.

FMCG rose 1.4%, while IT, Metal, Oil & Gas, PSU Bank, Pharma, Realty, and Telecom declined 0.5-1.8%.

💸 Market Transactions:

Foreign Institutional Investors (FII): Sold ₹5,588.91 crore

Domestic Institutional Investors (DII): Bought ₹6,372.71 crore

DII inflows mitigated FII outflows, but failed to prevent the day’s losses on monthly expiry.

📊📑 Important Observations and Market Sentiments: Editor Special

Markets started turbulent due to fresh US tariff threats but staged a recovery attempt, closing with marginal losses on the monthly F&O expiry day. Investors favored domestically oriented, non-discretionary stocks like FMCG for their attractive valuations, demand outlook, and tariff insulation.

Oil & Gas stocks were hit hardest by US warnings over Indian energy imports, while tariff concerns and geopolitical tensions (Russia-Ukraine) fueled caution. High hopes for a favorable tariff outcome persist, supported by domestic macros like a potential RBI rate cut, better monsoon, and strong Q1 GDP data (7.2% from June 2 context).

Analysts expect Nifty to consolidate around 24,700–24,900, with support at 24,500—monitor US policy shifts and Q1 earnings trends.

❓ DO YOU KNOW?

The US imposed a 25% tariff on Indian steel and aluminum today, marking the first escalation since May’s court reversal, intensifying trade tensions ahead of the US Fed meeting next week.

📰Stock News:

Key Stock Movements and News

Top Gainers: HUL, Jio Financial, Eternal, JSW Steel, and ITC

Top Losers: Adani Enterprises, Dr Reddy's Labs, Adani Ports, Tata Steel, and Sun Pharma

Hindustan Unilever (HUL) surged over 3% after a 7.64% YoY Q1 FY26 net profit rise to ₹2,732 crore, driven by FMCG demand.

Jio Financial rose 3% after board approval to issue 50 crore warrants at ₹316.50 each, raising ₹15,825 crore for promoters.

Tata Steel fell, among top losers, due to a 25% US tariff on Indian goods and weak global steel demand.

Adani Enterprises declined due to ongoing US Justice Department probe and tariff pressures.

Interglobe Aviation (IndiGo) dropped after a 20.2% YoY Q1 FY26 profit rise to ₹2,176 crore missed estimates, with revenue up 4.7% QoQ.

Hitachi Energy India surged with a 1,163% YoY Q1 FY26 profit jump to ₹131.6 crore, driven by high-margin exports and 11.4% revenue growth.

Jubilant Ingrevia gained after a 53% YoY Q1 FY26 profit rise to ₹75 crore, supporting chemicals.

Brigade Hotel Ventures listed with a 5% premium, reflecting strong IPO sentiment in hospitality.

Dabur India rose after a 16% YoY Q1 FY26 profit jump to ₹550 crore, fueled by FMCG demand.

Emami gained after a 10% YoY Q1 FY26 profit increase to ₹150 crore, driven by personal care sales.

Sun Pharma fell, hit by pharma sell-off and US tariff fears on drug exports.

Reliance Industries declined amid energy sector volatility and rising crude prices due to geopolitical tensions.

HDFC Bank traded flat, with mixed banking sentiment amid tariff uncertainties.

Your Weekly Stock Markets Rundown: Earnings and Global Cues to Drive a Volatile Week Ahead

July 28 – August 1, 2025

Bearish Trend Continues: The BSE Sensex fell 0.4% to 81,463, and the Nifty 50 dropped 0.5% to 24,837 for the week ended July 25, with broader markets (Nifty Midcap 100 down 1.85%, Smallcap 100 down 3.5%) under pressure due to weak Q1 FY26 earnings, cautious global sentiment, and FII outflows of Rs 13,553 crore.

Market Outlook: Consolidation is expected, with focus on Q1 earnings, the FOMC meeting, US trade deal updates by August 1, auto sales, and key US economic data, amid potential volatility from the monthly F&O expiry.

Expert Views: Consolidation amid India-US trade uncertainties and mixed earnings, while premium valuations are under strain from subpar earnings.

👀Stocks to Focus:

HUL: FMCG strength to monitor.

Jio Financial: Fundraise plans to watch.

Tata Steel: Tariff impact to observe.

📝Summary:

Indian markets fell 0.35%, with Nifty at 24,768, as tariff threats and F&O expiry triggered losses despite a recovery attempt. FMCG gained, while IT and Oil & Gas lagged. DII buying offset FII outflows, but global tensions persist—focus on US Fed policy next week!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.