- The Stock whisperer's Newsletter

- Posts

- 📉 Market Slips! Takes a Breather as FMCG Fizzles & Global Worries Loom 🌍💼

📉 Market Slips! Takes a Breather as FMCG Fizzles & Global Worries Loom 🌍💼

📰Daily Market Wrap-Up by Stock Whisperers-April 24

24-April-2025

📈 Market Overview:

Summary of the Day's Market Performance

Market Overview

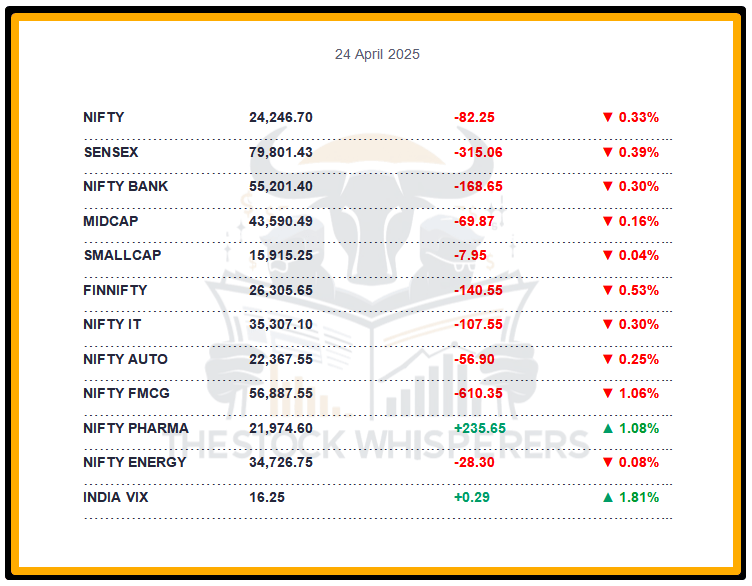

The Sensex fell 315.06 points (-0.39%) to close at 79,801.43 in a subdued session.

The Nifty dropped 82.25 points (-0.34%) to 24,246.70, slipping below 24,300.

Midcap and Smallcap indices ended flat, reflecting a cautious broader market.

All sectors closed in the red except Pharma (+1%), with FMCG notably underperforming.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹8,250.53 crore

Domestic Institutional Investors (DII): Sold ₹534.54 crore

Strong FII inflows failed to offset profit booking pressures, leading to a mild downturn.

📊📑 Important Observations and Market Sentiments: Editor Special

The domestic market saw profit booking after a recent 5-session rally, with global markets also facing selling pressure as hopes for a quick US-China tariff resolution (US tariffs at 245% on Chinese goods) faded.

FMCG Q4 results disappointed, with HUL and Nestle showing weak volumes and margin pressures, dragging the sector down. However, benign input prices and reviving urban/rural demand signal a potential recovery at reasonable valuations.

Pharma gained on positive stock-specific updates, while the RBI’s accommodative stance (6.00% repo rate) and low inflation (March CPI at a 5-year low) continue to support long-term sentiment. Near-term consolidation is likely amid mixed Q4 earnings.

❓ DO YOU KNOW?

FMCG sector’s Q4 PAT growth averaged just 2% YoY for majors like HUL and Nestle, the weakest since Q3FY22, hit by high base effects and sluggish demand.

📰Stock News:

Key Stock Movements and News

Top Gainers: IndusInd Bank, UltraTech Cement, Grasim Industries, Tata Motors, and Dr Reddy's Labs

Top Losers: HUL, Bharti Airtel, Eicher Motors, ICICI Bank, and Eicher

Adani Green Energy rose after its subsidiary signed a 1,250 MW energy storage pact with Uttar Pradesh Power Corporation.

Panacea Biotec gained traction on a $5.2 million UNICEF order.

Persistent Systems rose after reporting 18.8% FY25 growth with record AI-led revenues.

Aimtron Electronics rallied on robust Q4 results, boosting electronics sector sentiment.

Biocon drew focus after approving a ₹4,500 crore fundraise.

HUL’s Q4 profit rose 4% YoY to ₹2,493 crore, with a ₹24 final dividend (total ₹53/share), but shares dipped amid sector weakness.

Nestle India’s Q4 standalone PAT fell 5% YoY to ₹885 crore, impacting its stock.

Tata Power gained attention for eyeing solar exports in the renewable energy space.

Lupin rose on a $1.5 billion drug pipeline boost, strengthening its pharma portfolio.

Ambuja Cements, Jubilant FoodWorks, and SBI Cards were Nuvama’s top buys for their strong fundamentals.

Your Weekly Stock Markets Rundown: 🌍 Trade Turmoil Meets Monsoon Hope as Market Eyes Earnings & Rate Cuts

April 21-25, 2025

The week of April 21-25, 2025, unfolds amid a chaotic trade war between the US and China, testing global supply chains and market resilience. India’s Q4 FY25 earnings season progresses with key IT and financial results, following TCS’s cautious start, while easing inflation and a promising monsoon forecast bolster hopes for RBI rate cuts. However, FII volatility and rising US jobless claims temper optimism. Investors will watch PMI data, loan growth, and consumer confidence figures for direction, with opportunities in IT, consumer goods, and financial stocks amidst the uncertainty.

👀Stocks to Focus:

Persistent Systems: Strong Q4 may sustain momentum.

HUL: FMCG recovery potential to watch.

Lupin: Pharma pipeline growth signals upside.

📝Summary:

Indian markets slipped 0.4%, with Nifty below 24,300, as profit booking hit after a 5-session rally. All sectors dipped except Pharma (+1%), with FMCG lagging on weak Q4 results. FII inflows remained strong, but global tariff tensions and mixed earnings signal consolidation—focus on sector recovery cues!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.