- The Stock whisperer's Newsletter

- Posts

- Cautious Start: Markets Flat Ahead of RBI Policy & Holiday Week

Cautious Start: Markets Flat Ahead of RBI Policy & Holiday Week

📰Daily Market Wrap-Up by Stock Whisperers- September 29, 2025

September 29, 2025

📈 Market Overview:

Market Overview

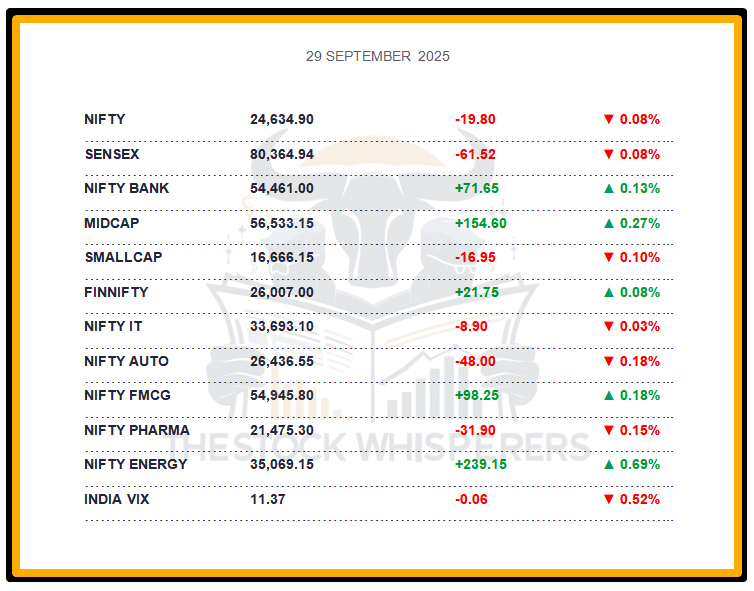

Summary of the Day's Market Performance

The Sensex fell 61.52 points (-0.08%) to close at 80,364.94, ending a volatile session flat.

The Nifty dropped 19.80 points (-0.08%) to 24,634.90, reflecting cautious trading.

Midcap index rose 0.3%, while Smallcap index dipped marginally, showing mixed broader market trends.

Oil & Gas, PSU Bank, Energy, and Realty added 1% each, while Media shed nearly 1%.

💸 Market Transactions:

Foreign Institutional Investors (FII): Sold ₹2,831.59 crore

Domestic Institutional Investors (DII): Bought ₹3,845.87 crore

DII inflows offset FII selling, stabilizing the market ahead of a holiday week.

📊📑 Important Observations and Market Sentiments: Editor Special

The domestic market ended flat in a volatile session as investors grew cautious before a holiday-truncated week and ongoing FII outflows. Uncertainty in U.S.-India trade deals (50% tariff impact) and pressure on IT & Pharma indices due to visa hikes ($100,000 cap) and tariffs are near-term concerns.

Investors await the RBI policy outcome, expected to maintain rates to curb rupee volatility (84.15 low), with supportive fiscal measures and a strong H2FY26 demand outlook potentially lifting the FY26 GDP forecast. Analysts expect Nifty to hover around 24,500–24,800, with support at 24,400—watch RBI and trade updates.

❓ DO YOU KNOW?

The rupee’s record low of 84.15, driven by U.S. tariff pressures, has prompted RBI to signal a steady repo rate (6.5%) at its October 2 meeting, per market speculation.

📰Stock News:

Key Stock Movements and News

Top Gainers: Eternal, Bharat Electronics, IndusInd Bank, Titan Company, and Wipro

Top Losers: Axis Bank, Maruti Suzuki, L&T, Apollo Hospitals, and Dr Reddy's Labs

BPCL, HPCL, and IOC rose up to 4.5% as brokerages turned upbeat on pricing reform clarity for crude oil and LPG under-recovery.

PG Electroplast gained 1.5% after acquiring a 50-acre land parcel in Andhra Pradesh’s Sri City.

IndusInd Bank rose 2.5% as Morgan Stanley upgraded it, citing inexpensive valuations despite a 50% drop last year.

Mahindra Logistics announced Ashay Shah’s resignation as Head of Customer Excellence, effective September 30.

Zaggle Prepaid Ocean Services partnered with IDFC First Bank for forex solutions, effective September 26, targeting corporate clients.

Uttam Distilleries Limited’s subsidiary approved expanding distillery capacity from 40 KLPD to 160 KLPD, with shares trading flat.

Ganesh Consumer shares settled 9% below IPO price on debut, listing at ₹295 on BSE (market cap ₹1,192.18 crore).

Tata Capital IPO GMP reached 9%, with allotment expected by October 9 and listing on October 13.

Markets Eye Fresh Triggers: Fed Cut Tailwinds, US Jobs Data & India-US Deal Buzz to Steer the Week Ahead

Weekly Stock Markets Rundown: September 29 To 3 October 2025

The week of September 29-October 3, 2025, follows a corrective close with Sensex at 82,323.62 and Nifty at 25,202.35, pressured by sector selloffs but buoyed by global records and trade progress. US Labor Day holiday kicks off a data-packed stretch, with ISM PMI (Sep 30), ADP jobs (Oct 1), and non-farm payrolls (Oct 3) in focus, alongside India's PMI final. FII outflows continue, but DIIs stabilize; India-US deal hopes and exemptions mitigate risks. Nifty eyes 25,200 breakout above 25,000 support—opportunities in banking, IT, pharma, and autos amid easing signals.

👀Stocks to Focus:

IndusInd Bank: Upgrade impact to monitor.

PG Electroplast: Land acquisition to watch.

Tata Capital: IPO buzz to observe.

📝Summary:

Indian markets fell 0.08%, with Nifty at 24,634, as caution ahead of a holiday week triggered volatility. Oil & Gas and PSU Banks gained, while Media lagged. DII buying offset FII outflows—focus on RBI policy next week!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.