- The Stock whisperer's Newsletter

- Posts

- Bulls Hold the Charge! Nifty Hits Fresh 52-Week High Despite Global Jitters

Bulls Hold the Charge! Nifty Hits Fresh 52-Week High Despite Global Jitters

📰Daily Market Wrap-Up by Stock Whisperers- October 17, 2025

October 17, 2025

📈 Market Overview:

Market Overview

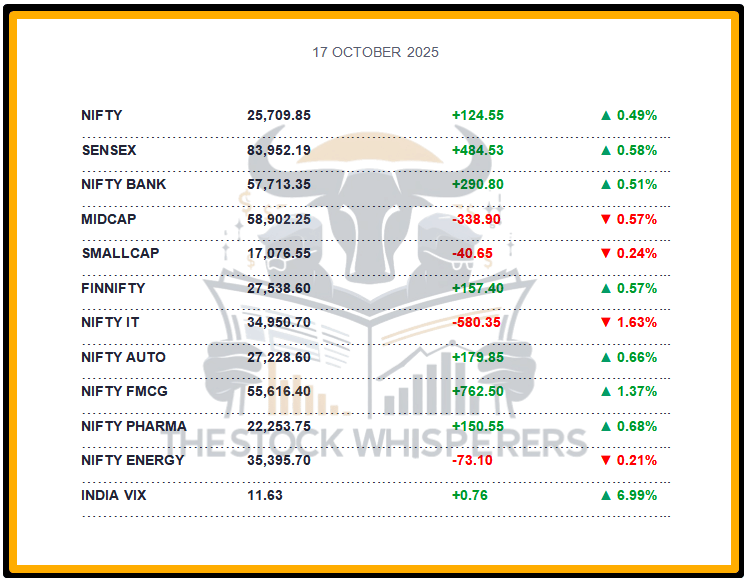

Summary of the Day's Market Performance

Indian markets extended their winning streak, with Nifty closing above 25,700 for the first time ever.

Sensex rose 484.53 points (0.58%) to 83,952.19, while Nifty gained 124.55 points (0.49%) to 25,709.85.

Midcap and Smallcap indices slipped 0.5%-0.2% each, indicating selective buying.

Sector-wise:

Gainers: Auto, Banking, Healthcare, FMCG, and Consumer Durables (up 0.5–1%).

Losers: Media, IT, Metal, and PSU Bank (down 0.5–1%).

Buying momentum was driven by consumption-oriented sectors and strong banking earnings, while IT stocks stayed under pressure.MCG, Realty, Banking, and Oil & Gas led the rally, while PSU Banks slipped 0.4%.

The uptrend was fueled by India–US trade optimism, softening dollar index, and dovish US Fed tone.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹303.98 crore

Domestic Institutional Investors (DII): Bought ₹1,526.61 crore

Both Foreign Institutional Investors (FII) and Domestic Institutional Investors (DII) remained net buyers, continuing to support the market’s upward trajectory.

📊📑 Important Observations and Market Sentiments: Editor Special

Nifty touched a new 52-week high, signaling strong domestic resilience despite global turbulence.

Banking stocks strengthened further as Q2 results indicated improving asset quality and steady credit growth.

Consumption-focused sectors like FMCG and Auto outperformed, hinting at a revival in volume growth.

IT sector weakness continued due to concerns around U.S. discretionary spending and macro uncertainties.

Global investors turned cautious amid trade war tensions and slowing global economic data, pushing gold prices to record highs.

Domestic market sentiment remained upbeat, cushioned by robust GDP growth and low inflation trends.

❓ DO YOU KNOW?

India’s Sensex has gained over 1200 points in just two trading sessions — marking one of the strongest mid-October rallies in the last five years! 📈

📰Stock News:

Key Stock Movements and News

Top Gainers: Asian Paints, Bharti Airtel, Max Healthcare, ITC, M&M

Top Losers: Wipro, Infosys, Eternal, HCL Technologies, Tech Mahindra

Central Bank of India Q2 net profit up 33% YoY to ₹1,213 crore; Gross NPA improved to 3.01% from 4.59%.

Tata Technologies reported 5% rise in Q2 profit to ₹166 crore; management remains confident of a Q4 rebound.

JSW Steel profit jumped nearly 4x YoY to ₹1,623 crore, though sequentially down 26%.

Yes Bank fell over 4% after SMBC ruled out increasing its stake further.

Paradeep Phosphates merged with Mangalore Chemicals & Fertilisers, boosting fertiliser capacity by 23% to 3.7 MTPA.

Embraer & Mahindra Group signed a strategic pact for India’s Medium Transport Aircraft programme.

BEML bagged a ₹282 crore defence order from the Ministry of Defence.

Anand Rathi Wealth set October 17 as the record date for its interim dividend.

Bulls Steady Ahead of Earnings Season, Inflation Data, and Trump vs China Trade Tensions!

Weekly Stock Markets Rundown: 13-17 October 2025

The week of October 13-17, 2025, builds on Nifty's close at 25,285.35 and Sensex at 82,500.82, with Q2 earnings (HCL Tech, Reliance) and inflation data (WPI Oct 13, CPI Oct 16) in the spotlight. US CPI and jobs report add global volatility, while FII buying signals easing pressures. Nifty eyes 25,400 upside above 25,000 support; focus on IT, diversified, and insurance stocks amid RBI cut hopes and trade progress.

👀Stocks to Focus:

JSW Steel – Strong earnings may attract momentum buying.

Central Bank of India – Improving asset quality supports long-term bullishness.

Tata Technologies – Likely to stay in focus after positive Q2 commentary.

BEML – Defence order could drive further upside.

Yes Bank – Watch for stability after sharp correction.

Embraer–Mahindra tie-up – Possible traction in aviation and defence segments.

📝Summary:

Indian markets continued their bullish momentum, achieving a new 52-week high despite global headwinds. Broad participation from Banking, Auto, and FMCG sectors and consistent FII–DII buying painted a positive picture. While IT weakness capped gains, the underlying tone remains optimistic. With festive demand and strong earnings in play, the bulls seem far from done yet! 🐂✨

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.