- The Stock whisperer's Newsletter

- Posts

- Bulls Back in Action! Markets Rally on Fed Optimism and India–US Trade Hopes Optimism Lift Markets Near 25,600!

Bulls Back in Action! Markets Rally on Fed Optimism and India–US Trade Hopes Optimism Lift Markets Near 25,600!

📰Daily Market Wrap-Up by Stock Whisperers- October 16, 2025

October 16, 2025

📈 Market Overview:

Market Overview

Summary of the Day's Market Performance

Indian equity markets ended on a strong note, driven by global optimism and festive-season cheer.

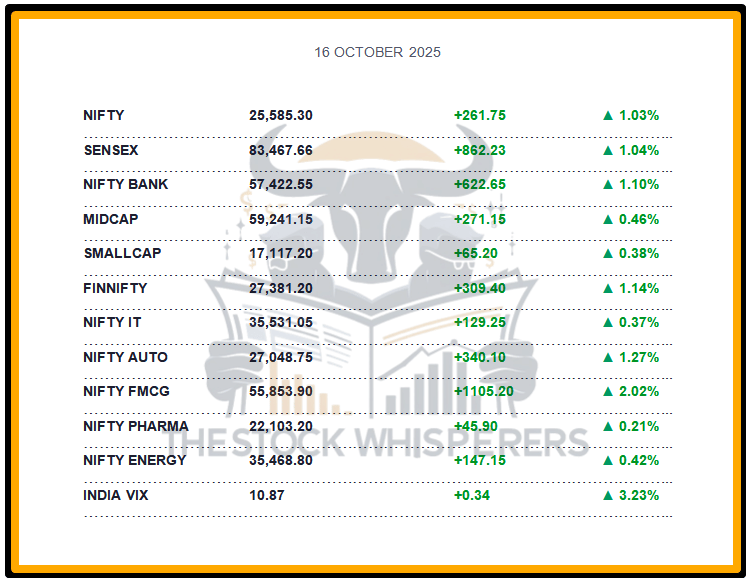

Sensex surged 862 points (1.04%) to close at 83,467.66, while Nifty gained 261 points (1.03%) to end at 25,585.30.

Midcap index rose 0.4%, and Smallcap index added 0.3%, showing broader market participation.

Sectorally, Auto, FMCG, Realty, Banking, and Oil & Gas led the rally, while PSU Banks slipped 0.4%.

The uptrend was fueled by India–US trade optimism, softening dollar index, and dovish US Fed tone.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹997.29 crore

Domestic Institutional Investors (DII): Bought ₹4,076.20 crore

Foreign Institutional Investors (FII) and Domestic Institutional Investors (DII) both remained net buyers, jointly fueling today’s strong upward momentum in the market.

📊📑 Important Observations and Market Sentiments: Editor Special

Global cues turned positive after dovish remarks from the US Fed and easing inflation expectations.

Festive demand hopes lifted sentiment in FMCG and Consumer Durable stocks.

Rupee appreciation added to market optimism, signaling confidence in foreign inflows.

Corporate earnings season remains key—markets now watching Q2 results for confirmation of growth trends.

Realty stocks gained on renewed institutional buying and an improving demand outlook.

❓ DO YOU KNOW?

Did you know that October has historically been one of the most volatile months for Indian equities — but also often marks the start of year-end rallies when festive demand and Q2 earnings combine to lift sentiment!

📰Stock News:

Key Stock Movements and News

Top Gainers: Nestle India, Tata Consumer, Titan Company, Kotak Mahindra Bank, Axis Bank

Top Losers: HDFC Life, Shriram Finance, Sun Pharma, Jio Financial, Eternal

BLS International surged 8% after bagging the MEA contract to manage visa centers in Beijing, Shanghai, and Guangzhou.

Infosys Q2 profit jumped 13% YoY to ₹7,364 crore; FY26 revenue guidance revised to 2–3%.

Wipro reported 1% profit growth at ₹3,246 crore with a 2% rise in revenue.

Indian Overseas Bank Q2 profit up 58% YoY to ₹1,226 crore, supported by higher interest income.

Zee Entertainment posted a 63% YoY drop in profit to ₹76.5 crore due to weaker ad revenues.

KEI Industries fell 6% on concerns over the delayed commissioning of its Sanand plant.

Oberoi Realty rallied on institutional buying amid strong quarterly momentum.

Bulls Steady Ahead of Earnings Season, Inflation Data, and Trump vs China Trade Tensions!

Weekly Stock Markets Rundown: 13-17 October 2025

The week of October 13-17, 2025, builds on Nifty's close at 25,285.35 and Sensex at 82,500.82, with Q2 earnings (HCL Tech, Reliance) and inflation data (WPI Oct 13, CPI Oct 16) in the spotlight. US CPI and jobs report add global volatility, while FII buying signals easing pressures. Nifty eyes 25,400 upside above 25,000 support; focus on IT, diversified, and insurance stocks amid RBI cut hopes and trade progress.

👀Stocks to Focus:

Infosys & Wipro – Post-earnings reactions and guidance watch.

BLS International – Further upside possible after MEA contract win.

Oberoi Realty – Institutional accumulation could extend the rally.

KEI Industries – Watch for stability post correction.

Zee Entertainment – Likely to remain volatile after weak Q2 numbers.

📝Summary:

Markets displayed strong resilience with broad-based gains across major sectors. Both FIIs and DIIs were net buyers, providing a solid foundation for continued momentum. Optimism from global cues, festive sentiment, and renewed domestic buying pushed indices higher. While the near-term trend remains bullish, corporate results and global signals will be key in determining the next leg of the rally.

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.