- The Stock whisperer's Newsletter

- Posts

- Profit Booking Pulls Indices Down – September 11

Profit Booking Pulls Indices Down – September 11

Daily Market Wrap-Up by Stock Whisperers

Market Overview:

Summary of the Day's Market Performance

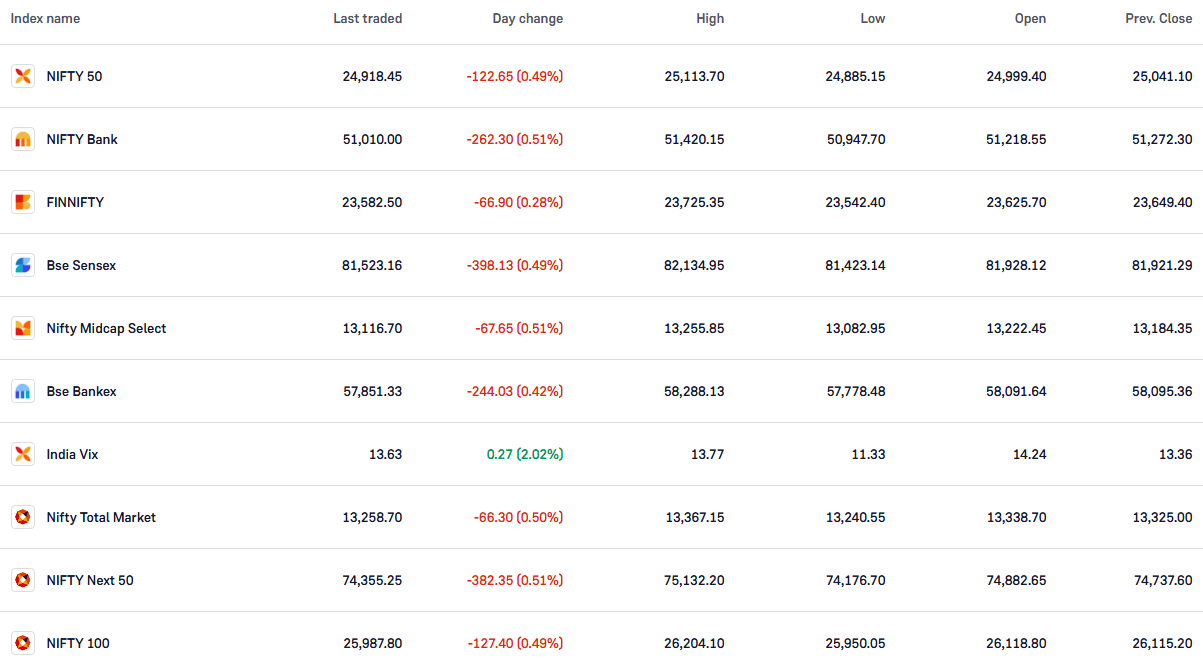

On September 11, Indian markets experienced profit booking at higher levels, leading to a weak close. The Sensex slipped 398 points or 0.49%, closing at 81,523.16, while the Nifty dropped 122.65 points or 0.49% to end at 24,918.45.

Profit booking was seen across several sectors, with Oil & Gas, PSU Banks, Metals, Auto, and Realty being the biggest laggards.

Sector Highlights:

Performance of Key Sectors

Top Gainers: Pharma and FMCG sectors were the outperformers, providing some support to the indices.

Top Losers: Oil & Gas, PSU Banks, Metals, and Auto sectors faced sharp declines due to profit booking and weaker global commodity prices.

Market Transactions:

• 📈FII Bought: 1,755 cr.

• 📈DII Bought: 230.90 cr.

Important Observations and Market Sentiments:

The domestic market saw minor consolidation in line with its Asian peers, influenced by the correction in commodity prices, especially crude, which collapsed to $70.

Cautious investor sentiment was evident due to concerns over the Chinese economic slowdown and the anticipation of key inflation data releases from the US and India.

US CPI is expected to show an uptick, while domestic inflation is forecasted to remain stable. Additionally, the Bank of Japan's hint at a potential rate hike also added to global market uncertainty.

Stock News:

Key Stock Movements and News

Top Gainers: Leading the gains were Asian Paints, Bajaj Finance, and Sun Pharma, which showed resilience amidst market weakness.

Top Losers: On the losing end, Tata Motors, NTPC, and Adani Ports & SEZ were among the biggest decliners.

Semiconductor Stocks Rally: Following PM Modi's Semicon India 2024 speech, RIR Power Electronics and SPEL Semiconductor hit upper circuits at 5%, while CG Power and ASM Technologies traded 2.5% higher. Moschip Technologies gained 4% in response to the positive sentiment in the sector.

Bharat Electronics: Secured orders worth Rs 1,155 crore from Cochin Shipyard, boosting investor confidence.

JSW Infrastructure: Shares surged on the company's plans to raise over Rs 5,000 crore through a QIP.

Varun Beverages: The stock advanced ahead of its record date for a stock split.

Gravita India: Signed an MoU to acquire a rubber recycling plant in Europe.

Sona BLW: Shares rose 3% as the firm raised Rs 2,400 crore via QIP.

Goa Carbon: Stock surged 9% after resuming operations at its Goa unit.

Tata Motors: UBS Securities maintained a 'sell' rating on Tata Motors, forecasting a 20% downside potential and retaining a price target of Rs 825.

Stocks to Focus On:

Tata Motors: UBS Securities maintained a 'sell' rating on Tata Motors, forecasting a 20% downside potential and retaining a price target of Rs 825. After correction there is an opportunity.

Summary:

"The Indian markets experienced profit-taking at higher levels, leading to a subdued close. As investors await key inflation data and global cues, caution may dominate the upcoming sessions. Eyes remain on commodity prices and global central bank actions."

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The information provided in this newsletter is for informational purposes only and should not be considered financial advice.

Follow us on Social Media