- The Stock whisperer's Newsletter

- Posts

- Nifty Reclaims 26,000! Bulls Take Charge Ahead of Fed Meet

Nifty Reclaims 26,000! Bulls Take Charge Ahead of Fed Meet

📰Daily Market Wrap-Up by Stock Whisperers- October 29, 2025

October 29, 2025

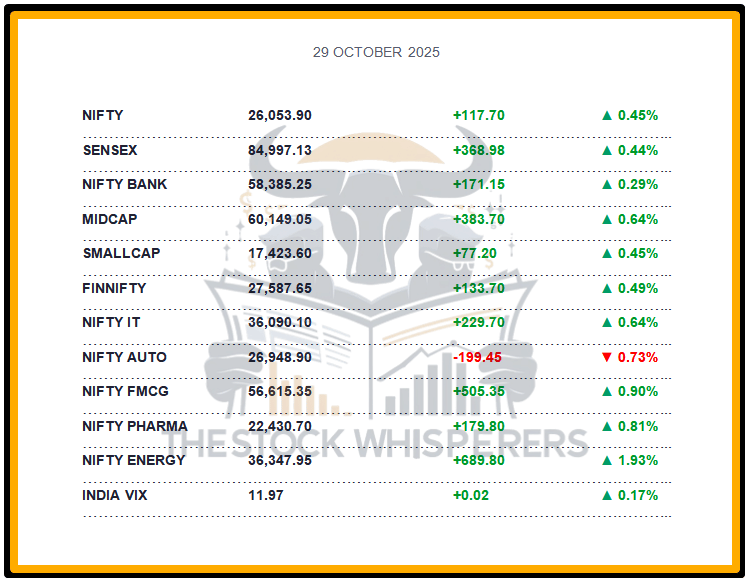

🧾Market Overview:

Indian equity indices extended their winning streak, with Nifty closing above 26,000 (+0.45%) and Sensex rising 369 points (+0.44%) to end at 84,997.

Midcap (+0.7%) and Smallcap (+0.5%) indices also participated in the rally, reflecting broad-based buying interest.

Barring Auto (-0.7%), all major sectoral indices ended in the green, led by Media, Metal, and Oil & Gas (up 1–2%).

Positive cues from Asian markets, coupled with optimism over India–US trade progress, lifted market mood.

Oil stocks surged as crude prices softened amid expectations of higher OPEC+ output.

Metal stocks gained on strong global commodity prices and supply concerns.

Investors now eye the US Fed decision, where a 25 bps rate cut is widely expected, but the commentary on future cuts will be key for market direction.

💸 Market Transactions💰:

Foreign Institutional Investors (FII): Sold ₹2,540.16 crore

Domestic Institutional Investors (DII): Bought ₹5,692.81 crore

Foreign Institutional Investors (FII) turned net sellers, while Domestic Institutional Investors (DII) heavily supported the market with strong net purchases.

📊📑 Important Observations and Market Sentiments: Editor Special

FII selling pressure was offset by robust domestic institutional inflows, keeping markets buoyant.

Oil & Gas and Metal sectors provided the much-needed thrust, reflecting strength in cyclicals.

Auto sector weakness hints at near-term demand moderation and higher inventory levels.

Investors remain watchful ahead of the Fed policy, as its stance could dictate short-term global liquidity flows.

Overall market breadth remains positive, showing strong confidence despite FII profit-booking.

❓ DO YOU KNOW?🤔

The Nifty 50 crossed 26,000 for the first time in history in 2025, driven by sustained DII inflows and robust earnings — a milestone achieved in less than 11 months since crossing 24,000 in late 2024! 🚀

📰Stock News:

Key Stock Movements and News

📈Top Gainers: Adani Enterprises, Power Grid Corp, NTPC, Adani Ports, JSW Steel

📉Top Losers: Dr Reddy’s Labs, Bharat Electronics, Eternal, M&M, Coal India

PB Fintech: Q2 net profit jumps 164% YoY to ₹135 crore, with revenue up 38%; sequential PAT up 59%.

Govt mulls Union Bank–Bank of India merger to form India’s 2nd largest PSU lender; discussions also include Indian Bank–IOB merger.

AMS Ltd: Gains up to 3% after securing ₹184.33 million in defense orders from DRDO and PSUs.

L&T: Net profit up 16% YoY to ₹3,926 crore; order inflow surges 45% to ₹67,984 crore.

Indian Oil, BPCL, HPCL: Jump up to 6% as crude oil prices extend decline.

Adani Energy Solutions: Shares rally 7% on bullish brokerage calls despite Q2 net profit dip.

Bosch: Shares fall 3.5% on supply chain risks from Nexperia export curbs.

boAt’s parent company gets SEBI nod for ₹1,500 crore IPO, aiming to fund working capital and expansion.

UPI transactions grow 35% in H1 2025, with merchant payments expanding 37% YoY, showing digital transaction dominance.

Fed Pause, FII Comeback & Earnings Rush: Markets Cool After Festive Highs Amid US-China Trade Tensions!

Weekly Stock Markets Rundown: 27-31 October 2025

The week of October 27-31, 2025, wraps Q3 with Sensex at 84,212 and Nifty at 25,795 after a mild pullback, as IT gains offset FMCG losses. Earnings from TCS, Infosys, and banks dominate, alongside the Fed's October 28-29 meeting (rate hold expected) and PCE data (Oct 27). FII inflows continue October's positive shift, buoyed by low inflation and RBI steadiness; Nifty eyes 26,000 above 25,500 support. Focus on IT, banking, and FMCG for quarter-end opportunities amid global liquidity and festive tailwinds.

👀Stocks to Focus🔍:

L&T – Strong Q2 and robust order book make it a steady performer.

Adani Enterprises – Gaining traction post strong sectoral momentum.

BPCL, HPCL, IOC – Likely to stay firm amid falling crude prices.

PB Fintech – Exceptional growth and profit jump signal strong business momentum.

Union Bank / Bank of India – Merger buzz may keep PSU banks in spotlight.

📝Summary🧩:

Markets remained upbeat as Nifty reclaimed the 26,000 mark, led by metals, oil & gas, and PSU strength.

Despite FII outflows, domestic buyers supported the rally.

With the Fed’s rate decision around the corner, short-term volatility may rise, but the underlying uptrend remains intact.

Dips continue to offer buying opportunities, especially in quality PSU, infra, and metal names.

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.