- The Stock whisperer's Newsletter

- Posts

- Nifty Nears 26,000! Markets Cheer Global Calm and Trade Optimism

Nifty Nears 26,000! Markets Cheer Global Calm and Trade Optimism

📰Daily Market Wrap-Up by Stock Whisperers- October 27, 2025

October 27, 2025

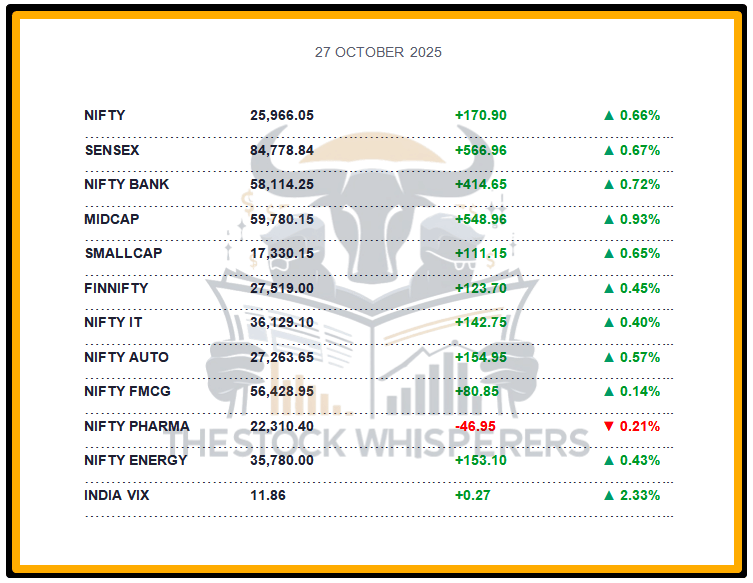

🧾Market Overview:

Indian markets extended their rally with broad-based buying and positive global cues.

Sensex jumped 566.96 points (0.67%) to close at 84,778.84, while Nifty gained 170.9 points (0.66%) to end at 25,966.05.

Midcap index rose 0.9% and Smallcap index gained 0.6%, indicating continued investor participation across the board.

Sector-wise:

Top performers: Metal, PSU Bank, Oil & Gas, and Realty (up 1–2%).

Laggards: Media and Pharma stocks ended marginally lower.

The rally was fueled by progress in US–China trade talks, expectations of a FED rate cut, and declining global uncertainty.

💸 Market Transactions💰:

Foreign Institutional Investors (FII): Sold ₹55.58 crore

Domestic Institutional Investors (DII): Bought ₹2,492.12 crore

Foreign Institutional Investors (FII) turned marginal sellers, while Domestic Institutional Investors (DII) provided strong buying support, keeping the market buoyant.

📊📑 Important Observations and Market Sentiments: Editor Special

Trade optimism between the US and China lifted risk appetite globally, easing investor nerves.

Gold prices dipped as safe-haven demand subsided, signaling improved market confidence.

Soft US CPI data raised expectations of a FED rate cut, further aiding global sentiment.

Domestic growth outlook remained robust amid policy reforms and corporate earnings momentum.

Valuations stay elevated, but justified by strong fundamentals and steady domestic inflows.

Market sentiment remains bullish as investors anticipate continued earnings upgrades and festive demand boosts.

❓ DO YOU KNOW?🤔

Even though FIIs were mild sellers today, DIIs have been net buyers for 10 consecutive sessions, marking one of their longest buying streaks of 2025! 💪📊

📰Stock News:

Key Stock Movements and News

📈Top Gainers: SBI Life Insurance, Bharti Airtel, Reliance Industries, SBI, Eternal

📉Top Losers: Bharat Electronics, Kotak Mahindra Bank, Infosys, Adani Ports, Bajaj Finance

Dr Lal PathLabs jumped 3% as its board will consider a bonus issue on October 31.

Adani Energy Solutions Q2 profit fell 21% YoY to ₹534 crore, but revenue rose 7% to ₹6,596 crore.

CPCL swung back to profit, posting ₹719 crore in Q2, supported by strong refinery margins.

Shriram Properties gained 6% intraday after signing a JDA for a housing project in North Bengaluru.

Reliance Industries rose 2% as Facebook picked a 30% stake in its AI venture, signaling digital growth synergy.

Godrej Properties added 3% after receiving RERA approval for its ₹10,000-crore Worli project.

SpiceJet soared 6% after announcing plans to double flights for winter and triple capacity by Nov 2025.

SEBI put Vedanta Group’s Sterlite Electric IPO on hold pending review.

Milky Mist, Curefoods, Steamhouse, and Kanodia Cement received SEBI IPO approval, reflecting continued primary market enthusiasm.

Fed Pause, FII Comeback & Earnings Rush: Markets Cool After Festive Highs Amid US-China Trade Tensions!

Weekly Stock Markets Rundown: 27-31 October 2025

The week of October 27-31, 2025, wraps Q3 with Sensex at 84,212 and Nifty at 25,795 after a mild pullback, as IT gains offset FMCG losses. Earnings from TCS, Infosys, and banks dominate, alongside the Fed's October 28-29 meeting (rate hold expected) and PCE data (Oct 27). FII inflows continue October's positive shift, buoyed by low inflation and RBI steadiness; Nifty eyes 26,000 above 25,500 support. Focus on IT, banking, and FMCG for quarter-end opportunities amid global liquidity and festive tailwinds.

👀Stocks to Focus🔍:

Reliance Industries – Positive sentiment after Facebook’s 30% stake in AI venture.

Godrej Properties – RERA nod could trigger further momentum.

Dr Lal PathLabs – Bonus issue consideration may drive short-term gains.

SpiceJet – Aviation revival and expansion plans look promising.

Shriram Properties – New JDA adds growth visibility.

CPCL – Strong refinery margins signal ongoing operational strength.

📝Summary🧩:

Indian equities ended on a strong note, edging closer to the 26,000 mark on the Nifty. Optimism over global trade developments, dovish Fed expectations, and strong domestic fundamentals kept sentiment upbeat. While FIIs booked mild profits, robust DII inflows and sectoral strength in PSU Banks, Metals, and Realty sustained the rally. The short-term outlook remains bullish with cautious optimism, as earnings season and global cues steer the next move.

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.