- The Stock whisperer's Newsletter

- Posts

- Nifty Ends Flat Amid Volatile Trade — Metals Shine, IT & Pharma Slip

Nifty Ends Flat Amid Volatile Trade — Metals Shine, IT & Pharma Slip

📰Daily Market Wrap-Up by Stock Whisperers- October 28, 2025

October 28, 2025

🧾Market Overview:

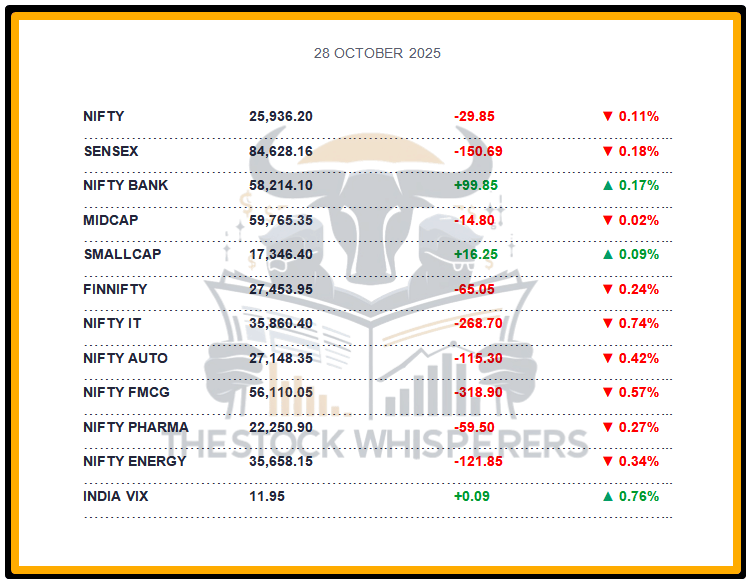

Indian equity markets ended lower in a volatile session, with Nifty closing at 25,936 (-0.11%) and Sensex at 84,628 (-0.18%).

Midcap and smallcap indices remained largely flat, showing mixed investor participation.

On the sectoral front, Metal and PSU Bank indices gained 1.2% each, while IT, Pharma, FMCG, and Realty slipped 0.5–1%.

Market witnessed profit booking on monthly expiry, but buying interest at lower levels reflected strong underlying sentiment.

China’s move to curb steel overcapacity boosted metal stocks; PSU banks gained amid reports of a possible increase in FII holding limits.

Overall, investors remain optimistic as global trade tensions ease and expectations of strong domestic corporate earnings continue.

💸 Market Transactions💰:

Foreign Institutional Investors (FII): Bought ₹10,339.80 crore

Domestic Institutional Investors (DII): Bought ₹1,081.55 crore

Foreign Institutional Investors (FII) and Domestic Institutional Investors (DII) remained net buyers, extending support to market momentum.

📊📑 Important Observations and Market Sentiments: Editor Special

Profit booking capped market upside post expiry, but buying at dips shows investor confidence.

Metals outperformed on positive China cues and global demand recovery hopes.

PSU Banks likely to attract more institutional inflows with regulatory flexibility on FII limits.

Traders expect sideways consolidation before a possible FED rate cut announcement later this week.

Overall tone remains constructive for medium-term investors despite short-term volatility.

❓ DO YOU KNOW?🤔

India ranks 4th globally in steel production, and the recent Chinese capacity curbs could make Indian steel exporters major beneficiaries in the coming quarters.

📰Stock News:

Key Stock Movements and News

📈Top Gainers: Tata Steel, SBI Life Insurance, JSW Steel, HDFC Life, L&T

📉Top Losers: Bajaj Finserv, Power Grid, ONGC, Coal India, Trent

Jindal Steel: Q2 net profit drops 26% to ₹635 crore; names Gautam Malhotra as new CEO.

Shree Cement: Net profit surges 200% YoY to ₹277 crore; declares ₹80 interim dividend.

Aditya Birla Real Estate: Reports ₹889 crore booking value in Q2, driven by Mumbai and Bengaluru projects.

Cabinet: Approves ₹37,952 crore fertilizer subsidy for the Rabi season to support the agriculture sector.

IDBI Bank: Shares rise 8% as the government prepares to invite bids for stake sale this week.

Fed Pause, FII Comeback & Earnings Rush: Markets Cool After Festive Highs Amid US-China Trade Tensions!

Weekly Stock Markets Rundown: 27-31 October 2025

The week of October 27-31, 2025, wraps Q3 with Sensex at 84,212 and Nifty at 25,795 after a mild pullback, as IT gains offset FMCG losses. Earnings from TCS, Infosys, and banks dominate, alongside the Fed's October 28-29 meeting (rate hold expected) and PCE data (Oct 27). FII inflows continue October's positive shift, buoyed by low inflation and RBI steadiness; Nifty eyes 26,000 above 25,500 support. Focus on IT, banking, and FMCG for quarter-end opportunities amid global liquidity and festive tailwinds.

👀Stocks to Focus🔍:

IDBI Bank – Positive momentum expected amid stake sale news.

Tata Steel & JSW Steel – Could benefit from China’s production cuts.

Shree Cement – Strong Q2 results and high dividend make it a potential outperformer.

Aditya Birla Real Estate – Robust bookings signal strong demand revival.

📝Summary🧩:

Markets traded cautiously but ended flat, with sectoral rotation visible between defensives and cyclicals.

Metals and PSU Banks carried strength, while IT and Pharma saw profit booking.

Institutional buying by both FIIs and DIIs hints at continued confidence, and with global cues turning softer, near-term dips may be viewed as buying opportunities.

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.