- The Stock whisperer's Newsletter

- Posts

- 📉 Markets Snap Winning Streak: Nifty Slips Below 23,500 as Profit Booking & US-India Trade Talks Weigh on Sentiment 🇺🇸🇮🇳

📉 Markets Snap Winning Streak: Nifty Slips Below 23,500 as Profit Booking & US-India Trade Talks Weigh on Sentiment 🇺🇸🇮🇳

📰Daily Market Wrap-Up by Stock Whisperers-March 26

26-March-2025

📈 Market Overview:

Summary of the Day's Market Performance

Market Overview

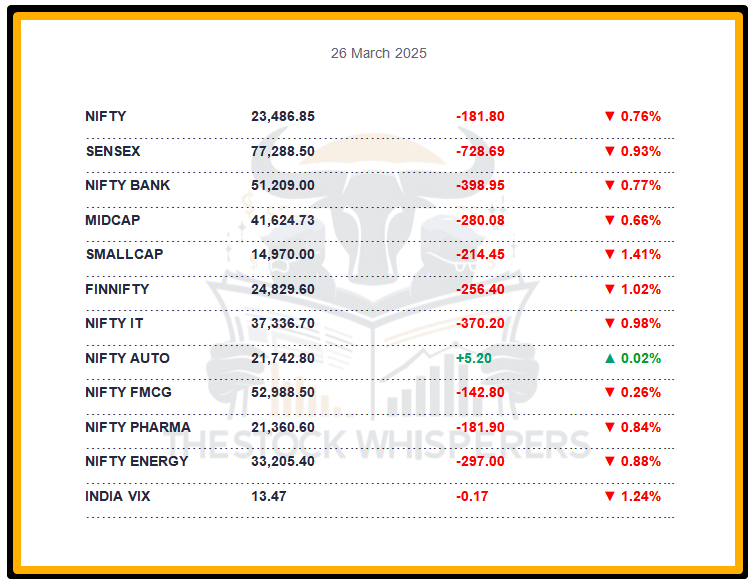

The Sensex declined 719.18 points (-0.93%) to close at 77,298.01, retreating from its 78,000 perch.

The Nifty fell 188.65 points (-0.80%) to 23,480.00, snapping its recovery rally.

Midcap shed 0.77%, and the Smallcap dropped 1.41%, reflecting broader weakness.

All sectoral indices ended in the red, except IT and capital goods, which posted minor gains.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹2,240.55 crore

Domestic Institutional Investors (DII): Sold ₹696.37 crore

FII buying cushioned the fall, but DII profit-taking drove the downturn amid expiry pressures.

📊📑 Important Observations and Market Sentiments: Editor Special

Profit booking stalled a 6-day rally as investors awaited clarity on US reciprocal tariffs, set for April 2, ahead of a pivotal US-India trade meet starting today.

The Bilateral Trade Agreement talks (ending Saturday) stoked nervousness, overshadowing rupee strength and rate cut hopes.

IT and capital goods held firm on global tariff optimism, but broader sectors buckled under valuation concerns.

Focus shifts to Q4 earnings and trade outcomes, with volatility likely until Saturday’s resolution.

❓ DO YOU KNOW?

The Nifty’s 23,480 close marks a 4.8% gain from its March 17 low of 22,397.20, but today’s drop signals caution after a ₹22 lakh crore market cap surge last week.

📰Stock News:

Key Stock Movements and News

Top Gainers: IndusInd Bank, Power Grid, Titan, and M&M

Top Losers: NTPC, Tech Mahindra, Zomato, Axis Bank, Bajaj Finance, and Infosys

BSE rose ahead of a March 30 board meeting to consider a bonus share issue.

JM Financial gained over 2% after hiking its stake in JMFCSL to 97.02%, eyeing a consumer brand investment.

Bharat Dynamics rose 2% on a ₹4,362 crore Ministry of Defence order, up 30% in a month.

HAL surged 3% as GE Aerospace delivered the first Tejas MK 1A engine from a ₹5,375 crore deal.

Bharti Airtel climbed after prepaying ₹6,000 crore in spectrum dues and redeeming $1 billion in debt.

MobiKwik gained on plans to enter stock broking and derivatives trading.

Trent surged 3% as Westside expanded to 244 stores with 3 new additions.

Ashok Leyland rose after denying a takeover of SML Isuzu, refuting earlier reports.

Amara Raja and Exide rose to 5% as lithium-ion batteries were classified as ‘core auto components.’

Zomato and Swiggy fell up to 3% after BofA Securities downgraded them, cutting targets (YTD: Zomato -29%, Swiggy -40%).

Laxmi Dental jumped 5% as Nuvama initiated coverage with a ₹570 target (38% upside).

Siemens India soared 8% on NCLT approval for its energy business demerger.

Your Weekly Stock Markets Rundown: 🌍 Global Jitters Rise- Uncertainty Looms as Key Data Awaited

March 24-28, 2025

After a blockbuster week, Indian markets brace for volatility as Trump-era uncertainty clouds US growth, impacting IT and consumer sectors. Flash PMIs, US spending, and RBI data will test last week’s 4% Nifty gain. Domestic resilience and FII inflows provide a buffer, but global headwinds loom—rangebound trade likely unless fundamentals shine.

👀Stocks to Focus:

Siemens India: Demerger momentum could sustain gains.

Zomato: Downgrade fallout may persist pre-expiry.

Bharat Dynamics: Defence order strength signals upside.

📝Summary:

Indian markets turned lower as profit booking hit after a 6-day rally, with Nifty slipping to 23,480 amid tariff uncertainty tied to the US-India trade meet. IT and capital goods eked out gains, but broader sectors faltered. FII buying offered support, yet caution reigns ahead of Saturday’s trade talks outcome and Thursday’s F&O expiry.

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.