- The Stock whisperer's Newsletter

- Posts

- ⚖️ Markets on Pause Mode! Nifty Stays Flat Amid Border Jitters & Mixed Earnings 🛑📉📈

⚖️ Markets on Pause Mode! Nifty Stays Flat Amid Border Jitters & Mixed Earnings 🛑📉📈

📰Daily Market Wrap-Up by Stock Whisperers-April 29

29-April-2025

📈 Market Overview:

Summary of the Day's Market Performance

Market Overview

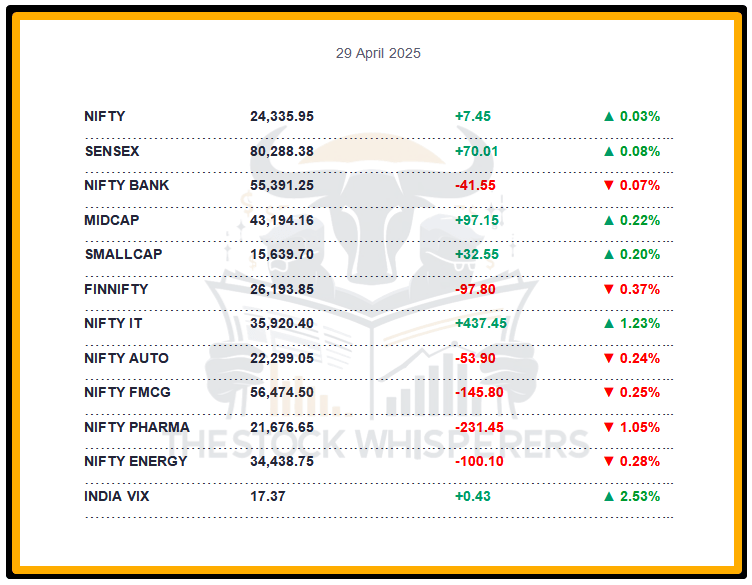

The Sensex edged up 70.01 points (+0.09%) to close at 80,288.38 in a volatile session.

The Nifty rose 7.45 points (+0.03%) to 24,335.95, holding near 24,300.

Midcap and Smallcap indices ended flat, reflecting a range-bound broader market.

Capital Goods, Consumer Durables, IT, and Oil & Gas added 0.5-1%, while Metal, Power, Telecom, and Pharma shed 0.5-1%.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹2,385.61 crore

Domestic Institutional Investors (DII): Bought ₹1,369.19 crore

Sustained FII and DII inflows supported sentiment, capping downside in a cautious market.

📊📑 Important Observations and Market Sentiments: Editor Special

The market traded range-bound as geopolitical concerns over India-Pakistan border tensions (post-Pahalgam attack) weighed on sentiment. FII inflows provided stability, while mixed Q4 results raised risks of FY26 earnings downgrades.

Easing US-China trade tensions (US tariffs at 245% on Chinese goods) lifted IT stocks, with majors like Tech Mahindra benefiting from US market exposure. However, potential retaliatory actions from border tensions may trigger near-term consolidation.

Domestic macros remain supportive with the RBI’s 6.00% repo rate and low inflation (March CPI at a 5-year low), but investors are advised to stay cautious amid mixed earnings and geopolitical risks.

❓ DO YOU KNOW?

Defence stocks like BEL have rallied 25% in April 2025, their best monthly gain since March 2023, driven by border tensions and India’s Rafale deal with France.

📰Stock News:

Key Stock Movements and News

Top Gainers: Bharat Electronics, Tech Mahindra, Reliance Industries, Eicher, and Trent

Top Losers: Sun Pharma, ONGC, Coal India, UltraTech Cement, and Dr Reddy’s Labs

Bharat Electronics surged on India’s Rafale deal with France, boosting defence sector sentiment.

Defence stocks (Paras Defence, BEL) extended gains up to 14% for the second day ahead of a Cabinet meet tomorrow.

UltraTech Cement dropped 2% post-Q4 results, reflecting investor caution despite strong fundamentals.

Bajaj Finance was in focus as its board discussed Q4 results and a potential stock split, eyeing a dividend announcement.

Bajaj Finserv also drew attention for Q4 results and a potential dividend declaration.

Trent gained as Q4 results were expected to show a 29% YoY revenue rise, lifting retail sentiment.

IndusInd Bank saw volatility amid ongoing forex derivatives concerns after its deputy CEO resigned.

KPIT Technologies reported a soft H1 FY26 outlook but projected 18-20% annual growth, leading to mixed stock movement.

Landmark Cars dipped after announcing its exit from Punjab operations to cut costs.

LTI Mindtree and Tech Mahindra rose 2% as the IT index rallied on easing US-China trade tensions.

Hatsun Agro fell as Q4 EBITDA dropped 2.3%, with margins at 10% vs. 11.2% YoY.

RPG Life declined as Q4 margin fell to 17.8% from 28% QoQ.

Adani Green Energy rose post-Q4 results, supported by a 1,250 MW energy storage pact.

Adani Total Gas gained despite an 8% YoY Q4 PAT drop to ₹154 crore, with revenue up 15% and a dividend announced.

Nippon Life India MF faced scrutiny as CBI questioned its ₹3,500 crore investment limit for ADAG companies.

Your Weekly Stock Markets Rundown: 🌪️ After the Storm: Markets Hold Breath Amid Geo Tensions, Global Rally Lifts Hopes! 📈🌏April 28- May 2, 2025

The week of April 28-May 2, 2025, begins with India’s market cautious after a dip triggered by India-Pakistan tensions, though US-China tariff de-escalation offers a silver lining with continued FII buying. Muted Q4 earnings temper optimism, but Nifty’s bullish stance above 24,000 suggests dip-buying potential. Key data like India’s manufacturing PMI, US jobless claims, and Euro Area GDP will guide sentiment, alongside Ather Energy’s IPO debut. Opportunities lie in IT, banking, and industrial stocks, with global cues and geopolitical developments in focus.

👀Stocks to Focus:

Bharat Electronics: Defence rally may continue.

Tech Mahindra: IT gains to monitor.

Bajaj Finance: Q4 results and split outcome key.

📝Summary:

Indian markets ended flat, with Nifty at 24,335, as border tensions and mixed Q4 results fueled caution. IT gained on easing US-China trade tensions, while Pharma lagged. FII and DII inflows capped losses, but geopolitical risks and earnings downgrades signal consolidation—watch the Cabinet meet and results!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.