- The Stock whisperer's Newsletter

- Posts

- 🔻 Markets End Flat Ahead of Fed Decision; Nifty Holds 24,800 Amid Global Jitters

🔻 Markets End Flat Ahead of Fed Decision; Nifty Holds 24,800 Amid Global Jitters

📰Daily Market Wrap-Up by Stock Whisperers-18 June 2025

18-June-2025

📈 Market Overview:

Market Overview

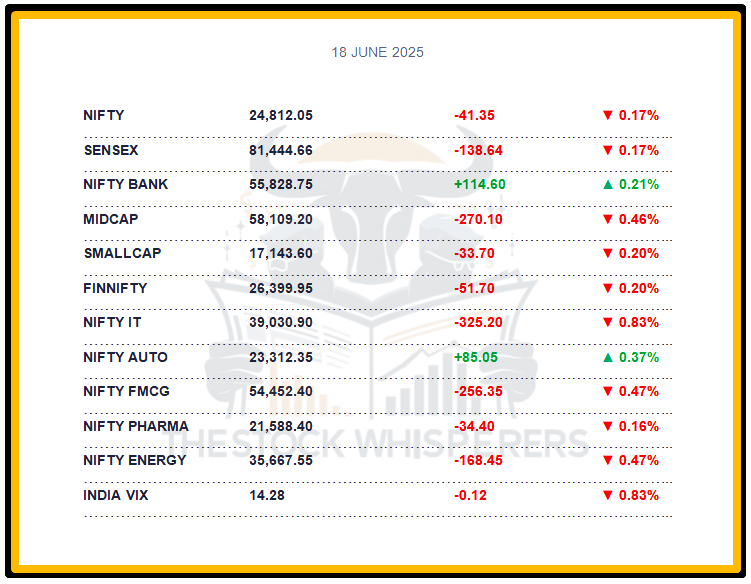

Summary of the Day's Market Performance

The Sensex fell 138.64 points (-0.17%) to close at 81,444.66, ending marginally lower.

The Nifty dropped 41.35 points (-0.17%) to 24,812.05, slipping below 24,850.

Midcap (-0.4%) and Smallcap (-0.2%) shed, reflecting cautious sentiment.

Auto, Private Bank, and Consumer Durables gained, while IT, Media, Metal, Oil & Gas, and Realty fell 0.5-1%.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹890.93 crore

Domestic Institutional Investors (DII): Bought ₹1,091.34 crore

Modest FII and DII inflows supported stability, despite the decline.

📊📑 Important Observations and Market Sentiments: Editor Special

Markets failed to hold opening gains as ongoing Middle East tensions (Israel-Iran) and volatile oil prices (Brent crude at $77.5/barrel) weighed on sentiment. Auto and Consumer Discretionary sectors rose on expectations of a demand revival, supported by domestic macros (May CPI at 3.8%, 7.2% Q4 GDP, RBI’s 5.75% repo rate).

Investors focused on high-quality large-caps amid uncertainty, awaiting the US Fed policy outcome later today. A potential tariff threat may push US inflation higher (est. 2.8% YoY), possibly leading the FOMC to maintain rates at 4.50-4.75% instead of a cut. Analysts expect Nifty to consolidate between 24,500–24,900, with support at 24,300—watch Fed decision and oil price trends.

❓ DO YOU KNOW?

Brent crude’s rise to $77.5/barrel today, up 13% this month, reflects heightened Middle East supply risks, potentially adding $3.2 billion to India’s Q2 FY26 oil import costs if sustained.

📰Stock News:

Key Stock Movements and News

Top Gainers: IndusInd Bank, Trent, Titan Company, Maruti Suzuki, and M&M

Top Losers: TCS, Adani Ports, JSW Steel, HUL, and Adani Enterprises

Welcure Drugs & Pharmaceuticals hit a 5% upper circuit at ₹8.27 on a ₹517 crore global sourcing mandate, projecting ₹25.85 crore service income over FY 2025-26 with a 5% commission.

Bharat Forge gained after signing an MoU with France’s Turgis Gaillard to offer the AAROK UAV to the Indian Ministry of Defence.

Hindustan Zinc rose after announcing a ₹12,000 crore investment over three years to scale refined-metal production by 250 KTPA.

Polycab India surged after securing a ₹6,447.54 crore contract from BSNL under the BharatNet project, boosting telecom infrastructure.

Delhivery gained following an acquisition to strengthen its e-commerce logistics market position.

Mahindra & Mahindra (M&M) rose after CCI approved its 58.96% stake acquisition in SML Isuzu.

SRF Ltd rose after the Vadodara CGST Commissioner set aside a ₹85.23 crore demand and penalty, providing regulatory relief.

Your Weekly Stock Markets Rundown:🌍 Global Triggers, Cooling Inflation & RBI Liquidity Boost to Steer D-Street This Week

June 16-20, 2025

The week of June 16-20, 2025, brings a packed calendar with the G7 Summit, central bank rate decisions, and key economic data releases. India’s falling inflation at 2.8% in May supports a growth-friendly environment, though global uncertainties like US tariffs and oil market trends may drive volatility. The RBI’s June meeting minutes and bank credit data will clarify policy transmission, while corporate actions like Zee Entertainment’s fundraising and Arisinfra Solutions IPO add dynamism. Investors should focus on banking, energy, and real estate, adopting a stock-specific approach amid global and domestic developments.

👀Stocks to Focus:

Polycab India: BSNL contract momentum to monitor.

M&M: Auto sector demand revival to watch.

TCS: IT sector resilience to observe.

📝Summary:

Indian markets fell 0.2%, with Nifty below 24,850, as Middle East tensions and oil price volatility ($77.5/barrel) offset domestic gains. Auto and Consumer Discretionary rose on demand hopes, while IT lagged. Investors await the US Fed policy—expect consolidation, focus on global cues!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.