- The Stock whisperer's Newsletter

- Posts

- 📉 Markets Drift Lower in Rangebound Trade; Broader Indices Take a Hit

📉 Markets Drift Lower in Rangebound Trade; Broader Indices Take a Hit

📰Daily Market Wrap-Up by Stock Whisperers-19 June 2025

19-June-2025

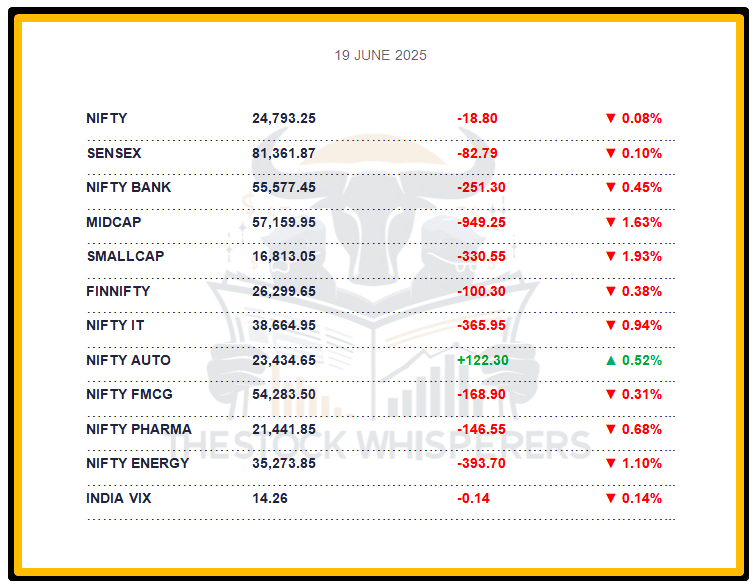

📈 Market Overview:

Market Overview

Summary of the Day's Market Performance

The Sensex fell 82.79 points (-0.10%) to close at 81,361.87, ending with marginal losses.

The Nifty dropped 18.80 points (-0.08%) to 24,793.25, reflecting a rangebound session.

Midcap and Smallcap indices fell over 1.5% each, underperforming the main indices.

Only Auto gained, while IT, Media, Metal, Realty, Oil & Gas, Pharma, Telecom, and PSU Bank fell 0.5-2%.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹1,008.43 crore

Domestic Institutional Investors (DII): Bought ₹365.68 crore

Modest FII and DII inflows provided some support, despite the decline.

📊📑 Important Observations and Market Sentiments: Editor Special

Markets traded rangebound with a negative bias as global caution grew over potential US involvement in the Middle East conflict (Israel-Iran). The Fed’s decision yesterday to hold rates at 4.50-4.75%, citing persistent inflation (2.8% YoY) and slower growth, hit software export stocks, notably IT. Brent crude rose to $78/barrel, adding pressure due to India’s oil import reliance.

Broader markets lagged, with Midcap and Smallcap selling reflecting valuation concerns, while large-cap growth stocks showed stability. Domestic macros (May CPI at 3.8%, 7.2% Q4 GDP, RBI’s 5.75% repo rate) remain supportive, but global headwinds dominate—analysts expect Nifty to consolidate between 24,500–24,900, with support at 24,300.

❓ DO YOU KNOW?

Brent crude’s climb to $78/barrel today, a 2025 high, reflects Middle East supply risks, potentially raising India’s Q2 FY26 oil import costs by $3.5 billion if sustained, per industry estimates.

📰Stock News:

Key Stock Movements and News

Top Gainers: Tata Consumer, Eicher Motor, M&M, Wipro, and Dr Reddy’s Laboratories

Top Losers: Adani Ports, Bajaj Finance, Shriram Finance, Tech Mahindra, and Adani Enterprises

IKS Health saw 30 lakh shares worth ₹499 crore change hands in a block deal, drawing investor attention as a Jhunjhunwala family-backed healthcare tech firm.

Bharti Airtel gained on reports of a potential $1 billion Google investment, boosting telecom sentiment.

ONGC declined as rising crude oil prices (Israel-Iran conflict) hit oil & gas sentiment.

Allcargo Gati rose after announcing a new logistics contract, lifting interest in the logistics sector.

Laxmi Organic traded flat after the Bombay High Court dismissed its writ petition against MSEDCL.

Your Weekly Stock Markets Rundown:🌍 Global Triggers, Cooling Inflation & RBI Liquidity Boost to Steer D-Street This Week

June 16-20, 2025

The week of June 16-20, 2025, brings a packed calendar with the G7 Summit, central bank rate decisions, and key economic data releases. India’s falling inflation at 2.8% in May supports a growth-friendly environment, though global uncertainties like US tariffs and oil market trends may drive volatility. The RBI’s June meeting minutes and bank credit data will clarify policy transmission, while corporate actions like Zee Entertainment’s fundraising and Arisinfra Solutions IPO add dynamism. Investors should focus on banking, energy, and real estate, adopting a stock-specific approach amid global and domestic developments.

👀Stocks to Focus:

Bharti Airtel: Google's investment potential to monitor.

ONGC: Oil price impact to watch.

M&M: Auto sector demand revival to observe.

📝Summary:

Indian markets fell 0.1%, with Nifty at 24,793, in a range-bound session as Middle East tensions and rising oil prices ($78/barrel) offset domestic gains. Auto rose in hopes of demand, while IT lagged post-Fed decision. FII/DII buying cushioned losses—focus on global cues!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.