- The Stock whisperer's Newsletter

- Posts

- 📉 Market as Global Tensions and Oil Spike Rattle Markets

📉 Market as Global Tensions and Oil Spike Rattle Markets

📰Daily Market Wrap-Up by Stock Whisperers-17 June 2025

17-June-2025

📈 Market Overview:

Market Overview

Summary of the Day's Market Performance

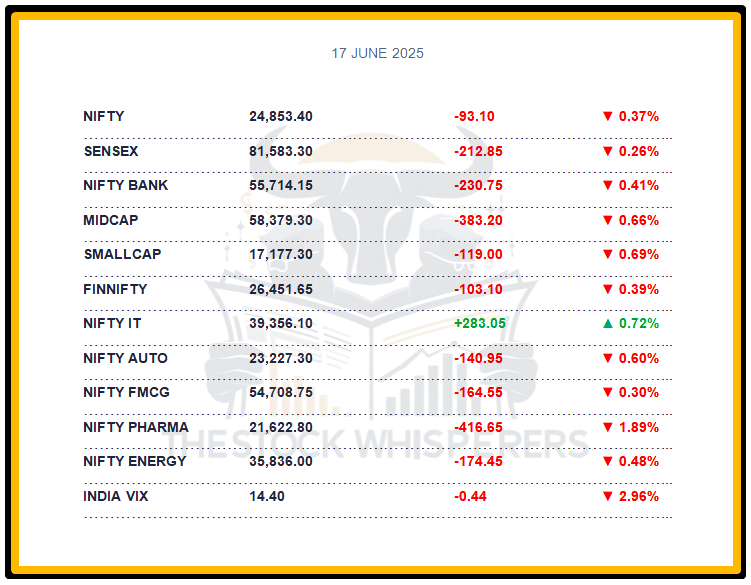

The Sensex fell 212.85 points (-0.26%) to close at 81,583.30, ending on a negative note.

The Nifty dropped 93.10 points (-0.37%) to 24,853.40, settling around 24,850.

Midcap and Smallcap indices shed 0.6% each, reflecting broader market weakness.

IT gained modestly, while Pharma, Metal, Oil & Gas, Auto, Realty, and PSU Bank fell 0.5-2%.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹1,616.19 crore

Domestic Institutional Investors (DII): Bought ₹7,796.57 crore

Strong FII and DII inflows cushioned the decline, despite global concerns.

📊📑 Important Observations and Market Sentiments: Editor Special

Markets saw moderate losses as escalating Israel-Iran tensions, ahead of the FOMC meeting (ongoing today), raised concerns. Brent crude rose to $77/barrel, a 2025 high, pressuring India’s oil import bill and dampening earnings growth in energy-reliant sectors like Oil & Gas and Auto.

IT saw rebalancing gains, driven by a strengthening US dollar (dollar index at 103.5 today) and anticipation of the Fed’s rate decision (25 bps cut to 4.25-4.50% expected). Pharma and Metals faced selling pressure amid global healthcare weakness and commodity volatility. Analysts expect Nifty to consolidate between 24,500–24,900, with support at 24,300—focus on FOMC outcomes and Middle East developments.

❓ DO YOU KNOW?

Brent crude’s rise to $77/barrel today, up 12% this month, could increase India’s FY26 oil import bill by $3 billion if sustained, per industry estimates, impacting inflation and corporate margins.

📰Stock News:

Key Stock Movements and News

Top Gainers: Tech Mahindra, Infosys, Asian Paints, TCS, and Maruti Suzuki

Top Losers: Adani Enterprises, Dr Reddy’s Labs, Sun Pharma, Eternal, and ONGC

Sun Pharma fell sharply, among the top Nifty 50 losers, as the Nifty Pharma Index dropped due to profit-taking and global healthcare weakness.

Biocon gained after initiating a ₹4,500 crore QIP, boosting biotech sector interest.

Tanla Platforms rose as its board approved a ₹175 crore share buyback at ₹875/share, covering 1.49% equity.

Zee Entertainment traded flat after issuing 16.95 crore convertible warrants to the promoter group at ₹132 each.

NBCC India gained after securing a ₹173 crore work order, supporting infrastructure sentiment.

Raminfo Ltd hit a 20% upper circuit on new order wins, defying the market sell-off.

Indian Overseas Bank rallied 4% on reports of accelerated government stake sales in PSU banks.

Punjab & Sind Bank rose 4%, supported by similar PSU bank stake sale reports.

ONGC fell as rising crude prices (Israel-Iran conflict) hit oil & gas sentiment.

Hindustan Zinc traded flat, going ex-dividend with a record date of today for a ₹10/share dividend.

Shankara Building Products gained 4.85% to ₹1,088.05, going ex-dividend with a ₹3/share dividend.

ICICI Bank remained stable after RBI approved Sandeep Batra’s re-appointment as Executive Director for two years from December 23, 2025.

Your Weekly Stock Markets Rundown:🌍 Global Triggers, Cooling Inflation & RBI Liquidity Boost to Steer D-Street This Week

June 16-20, 2025

The week of June 16-20, 2025, brings a packed calendar with the G7 Summit, central bank rate decisions, and key economic data releases. India’s falling inflation at 2.8% in May supports a growth-friendly environment, though global uncertainties like US tariffs and oil market trends may drive volatility. The RBI’s June meeting minutes and bank credit data will clarify policy transmission, while corporate actions like Zee Entertainment’s fundraising and Arisinfra Solutions IPO add dynamism. Investors should focus on banking, energy, and real estate, adopting a stock-specific approach amid global and domestic developments.

👀Stocks to Focus:

Sun Pharma: Pharma sector weakness to monitor.

Biocon: QIP impact to watch.

ONGC: Oil price escalation effects to observe.

📝Summary:

Indian markets fell 0.4%, with Nifty at 24,853, as Israel-Iran tensions pushed Brent crude to $77/barrel, impacting Oil & Gas and Auto. IT gained on a stronger US dollar and Fed rate cut hopes, while FII and DII buying cushioned losses. Focus on FOMC outcomes and Middle East updates!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.