- The Stock whisperer's Newsletter

- Posts

- Indian Markets Plummet Amid Global Geopolitical Concerns–September 30

Indian Markets Plummet Amid Global Geopolitical Concerns–September 30

Daily Market Wrap-Up by Stock Whisperers

Market Overview:

Summary of the Day's Market Performance

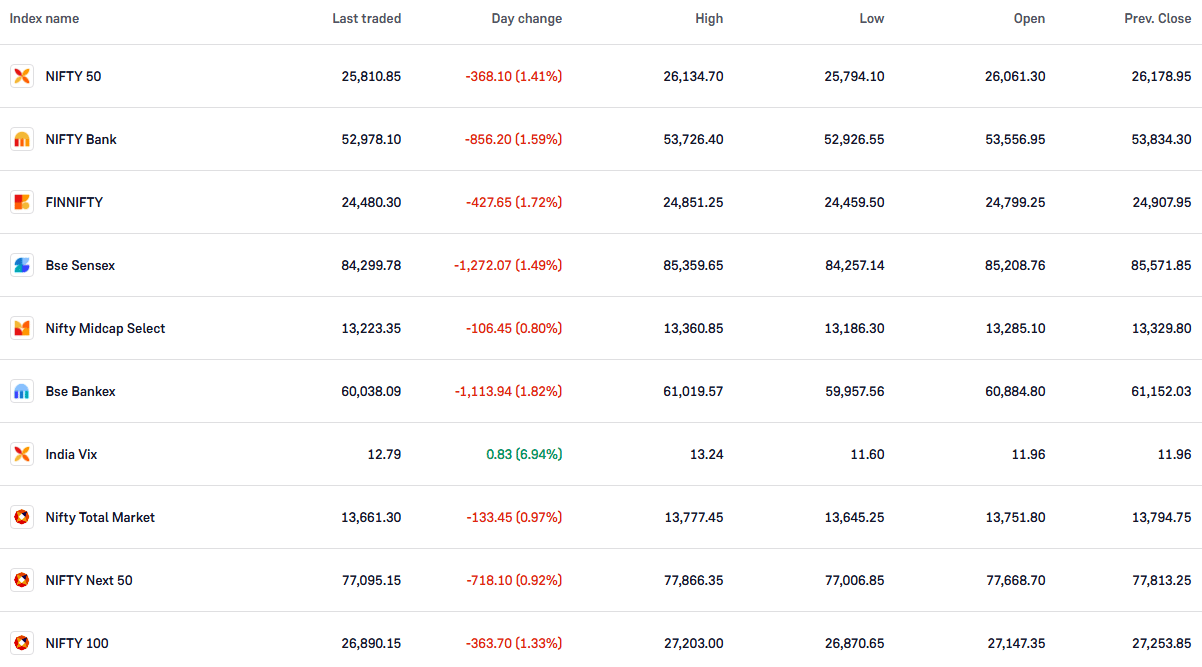

Indian equity indices ended on a weak note on September 30, with Nifty slipping below 25,850.

Sensex fell sharply by 1,272 points to close at 84,299.78, while Nifty dropped 368 points to end at 25,810.80.

The BSE Midcap index ended with marginal losses, while the Smallcap index remained flat.

Indian markets succumbed to global pressures and premium valuations, although metals are expected to outperform in the near-term. Focus now shifts to upcoming Q2 results, with expectations of an earnings recovery after a lackluster Q1.

Sector Highlights:

Performance of Key Sectors

Gainers: Metal, Media (up 1% each).

Losers: Auto, Bank, IT, Telecom, Pharma, Realty (down 1-2%).

Market Transactions:

Foreign Institutional Investors (FII): ₹-9,791.93 crore (Net Sellers)

Domestic Institutional Investors (DII): ₹6,645.80 crore (Net Buyers)

Foreign investors aggressively sold off their holdings amidst global uncertainties, while domestic investors continued to buy.

Important Observations and Market Sentiments: Editor Special

Geopolitical Tensions: Global risk-off sentiment grew due to rising geopolitical tensions in the Middle East.

China's Rebound: The Chinese market saw a resurgence, benefiting from stimulus measures and attractive valuations.

Q2 Earnings Focus: Market participants are now focused on the upcoming Q2 results, expecting earnings growth to bounce back after a weak Q1.

Do You Know:

Sensex may hit the 1 lakh mark by December 2024 amid a long-term bull trend, According to Mark Mobius

Stock News:

Key Stock Movements and News

Top Gainers: JSW Steel, Hindalco Industries, NTPC, Tata Steel, Britannia Industries.

Top Losers: Hero MotoCorp, Trent, Axis Bank, Reliance Industries, Bharat Electronics.

Manba Finance debuted strongly, closing 27% higher than its IPO price of ₹120 per share.

Bank of Maharashtra plans to launch a QIP to raise up to ₹3,500 crore.

LIC reduced its stake in Mahanagar Gas from 9.03% to 6.939% in September.

Reliance Infrastructure gained 4% after Calcutta HC upheld a ₹780 crore arbitration award in the Damodar Valley dispute.

Shakti Pumps hit a 5% upper circuit on news that it will consider a 5:1 bonus issue on October 7.

Bharti Airtel prepaid ₹8,465 crore for high-cost liabilities related to the spectrum acquired in 2016, strengthening its balance sheet and reducing future financial burdens.

Varun Beverages was in focus after HSBC initiated coverage on the stock, projecting a 28% upside from current levels.

Ola Electric stock fell 4%, dropping below ₹100 for the first time since listing.

NMDC gained 4%, riding on the rally in global ore prices after China's housing stimulus.

Jefferies maintained its 'buy' rating on NTPC, with a target price of ₹485.

Stocks to Focus:

Varun Beverages: HSBC’s 28% upside projection makes this stock attractive for the long term.

NMDC: Benefiting from rising global ore prices, driven by China's housing stimulus.

Summary:

Indian markets witnessed a sharp correction under global geopolitical tensions, with the Nifty dipping below 25,850. While metals and media stocks saw gains, most sectors ended in the red as investor sentiment turned cautious. With foreign investors selling off in large quantities, domestic buying offered some support. As markets shift focus to Q2 earnings, expectations for a stronger performance in the upcoming quarter could provide the much-needed impetus for a market recovery.

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The information provided in this newsletter is for informational purposes only and should not be considered financial advice.

Follow us on Social Media