- The Stock whisperer's Newsletter

- Posts

- Daily Market Wrap-Up by Stock Whisperers: 23-AUGUST-2024

Daily Market Wrap-Up by Stock Whisperers: 23-AUGUST-2024

Nifty Ends Flat Amid Volatility

Market Overview:

Summary of the Day's Market Performance

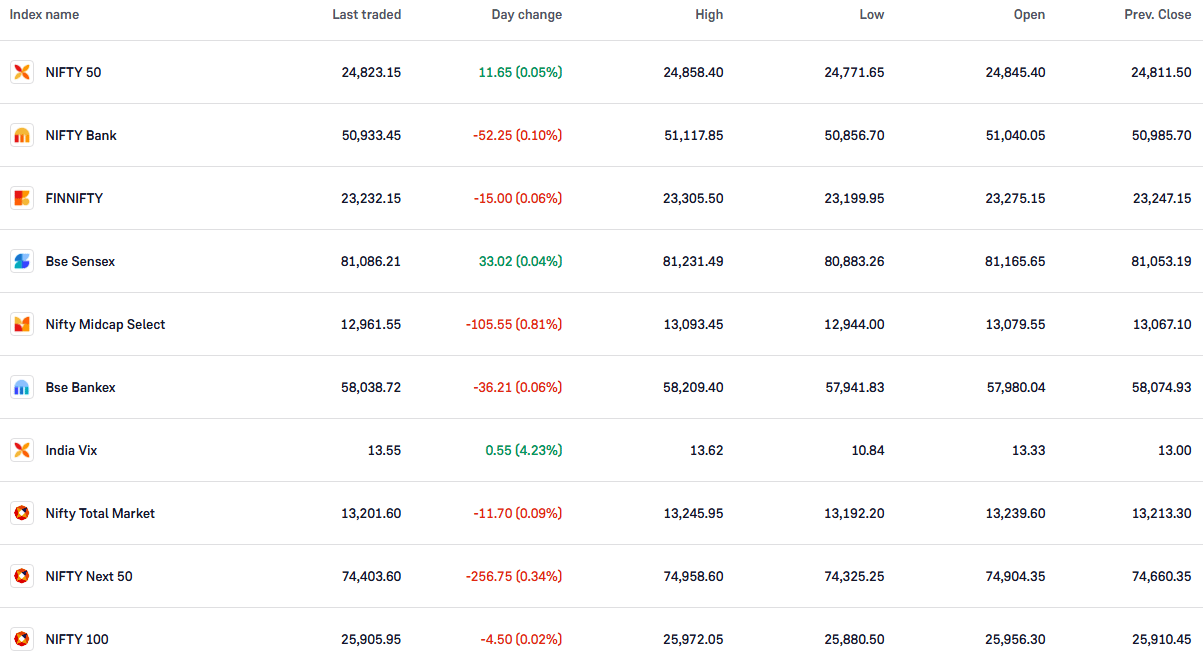

Indian benchmark indices ended flat in a volatile session on August 23. The Sensex inched up by 80.12 points (+0.10%) to close at 81,133.31, while the Nifty added a mere 11.70 points (+0.05%) to settle at 24,823.20.

The BSE Midcap index declined by 0.6%, while the Smallcap index ended flat.

Sector Highlights:

Performance of Key Sectors

Gainers: The Auto sector led the gains, rising by 1%.

Losers: Sectors like Metal, Realty, Media, PSU Bank, and IT faced selling pressure, declining between 0.5%-2.5%.

Market Transactions:

• 📈FII Bought: 1,944.48 cr.

• 📈DII Bought: 2,896.02 cr.

Important Observations and Market Sentiments:

"The market experienced a choppy session as investors remained cautious ahead of key macroeconomic data releases. While the Auto sector showed resilience, the broader market struggled to find clear direction, reflecting the ongoing uncertainty."

Stock News:

Key Stock Movements and News

Top Gainers: Bajaj Auto, Coal India, Tata Motors, Sun Pharma, and Bharti Airtel were the major gainers on the Nifty.

Top Losers: Wipro, ONGC, Divis Labs, LTIMindtree, and Infosys were among the top losers

Tata Power Solar Systems: Collaborated with ICICI Bank to provide loans for financing solar panels/units for residential and corporate customers.

APL Apollo Tubes: Received a GST tax demand notice.

Orient Tech IPO: The IPO was subscribed 133.20 times on Day 3, reflecting strong investor demand.

Reliance Power: Shares fell after SEBI imposed a five-year ban on Anil Ambani from the securities market, affecting investor sentiment towards the group companies.

Alpha TC Holdings: Sold its entire stake (75 lakh shares) in Tata Tech in a block deal at ₹1,010-1,020 per share range.

Jindal Saw: Approved a stock split, with each share being split into two.

Bikaji Foods: Approved the acquisition of a 55% stake in Ariba Foods for ₹60.5 crore.

Jain Irrigation Systems: Signed an MoU with the Coffee Board of India, marking its foray into the coffee sector.

Nykaa: Shares extended gains amid a block deal.

Delhivery: Shares rose as HSBC projected a 20% upside, citing superior cost economics.

Sun Pharma: Launched a new treatment for skin infections in India, further expanding its product portfolio.

Kaynes Technology: Inaugurated a new manufacturing facility in Hyderabad, signaling its expansion in the electronics manufacturing sector.

NCLT Approval: Adani Power’s share price rose by 2% following the NCLT's nod for the acquisition of Lanco Amarkantak Power.

Infosys: The government is likely to take a formal decision on Infosys' ₹32,000-crore tax case at the September 9 GST meeting.

Zomato: Announced the closure of its Intercity Legends service as it focuses on other business avenues.

Join Our Exclusive Telegram Community: The Trading Whisperers

We are excited to announce the launch of our new Telegram group, The Trading Whisperers—a community designed for serious traders. This group is the perfect space for passionate traders to come together, and share insights, strategies, and trading ideas. Whether you're a seasoned trader or just starting out, you'll find valuable discussions that can help you sharpen your trading skills.

Why Join?

Connect with like-minded traders who are just as committed to the market as you are.

Access daily trading insights and strategies.

Learn from experienced traders and grow your trading expertise.

How to Join: Simply message us at https://t.me/Teamwhispers to gain access. Please note that there is a one-time entry fee to join this exclusive community.

Don’t miss out on this opportunity to elevate your trading journey!

Stocks to Focus On:

Tata Power Solar Systems collaborated with ICICI Bank to provide loans for financing solar panels/units for residential and corporate customers, reflecting its commitment to expanding its renewable energy footprint.

Summary:

"Despite the volatility, the market managed to end on a positive note, albeit marginally. As we move forward, investors will be closely monitoring key corporate developments and regulatory updates to gauge market direction."

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The information provided in this newsletter is for informational purposes only and should not be considered financial advice.

Follow us on Social Media