- The Stock whisperer's Newsletter

- Posts

- Daily Market Wrap-Up by Stock Whisperers: 20-AUGUST-2024

Daily Market Wrap-Up by Stock Whisperers: 20-AUGUST-2024

Nifty Nears 24,700 as Market Gains Momentum! 🚀

Market Overview:

Summary of the Day's Market Performance

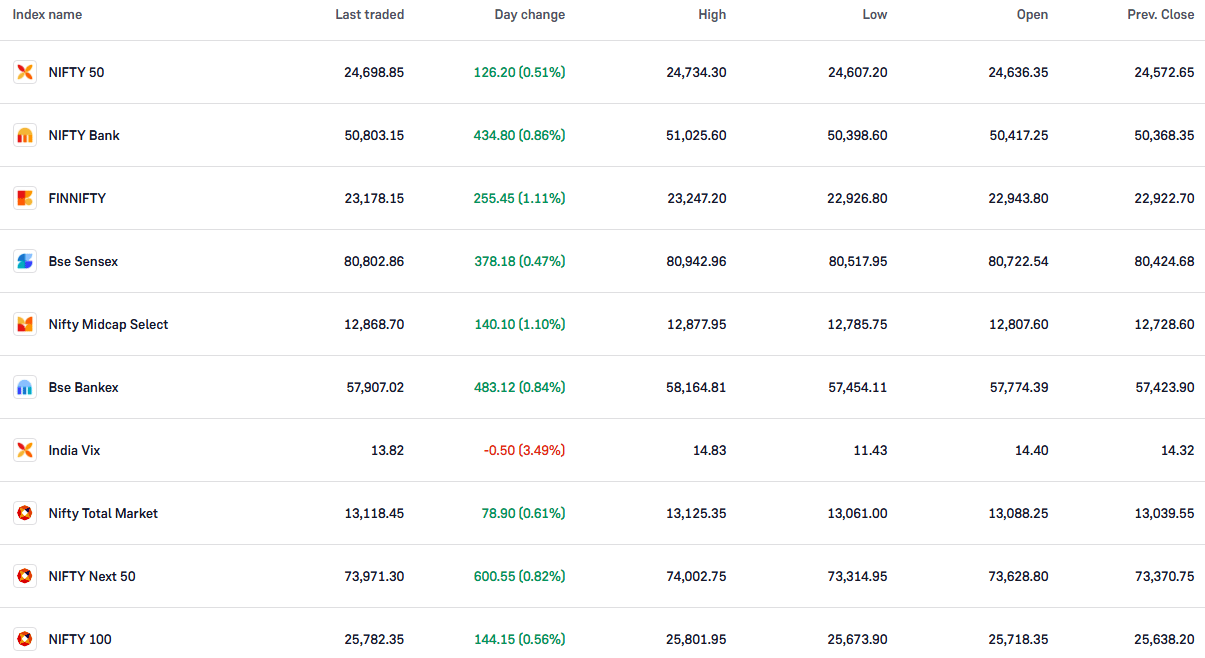

Indian benchmark indices ended higher on August 20, with the Sensex rising 378.18 points (+0.47%) to close at 80,802.86 and the Nifty advancing 126.10 points (+0.51%) to finish at 24,698.80.

The broader market reflected the positive sentiment, with the BSE Midcap Index gaining 1% and the Smallcap Index adding 0.5%. market segments.

Sector Highlights:

Performance of Key Sectors

Sectoral performance was largely positive, with the Banking, Healthcare, IT, Metals, and Power sectors leading the gains, rising between 0.5% and 1%.

FMCG was the only sector to end in the red.

Market Transactions:

• 📉FII Sold: -1,457.96 cr.

• 📈DII Bought: 2,252.10 cr.

Important Observations and Market Sentiments:

"Today’s gains were driven by strong performances in the banking and healthcare sectors, coupled with positive global cues. Despite the weakness in FMCG, the overall sentiment remained bullish, particularly with midcaps and smallcaps showing resilience."

Stock News:

Key Stock Movements and News

Top Gainers: SBI Life Insurance, HDFC Life, Bajaj Finserv, Shriram Finance, and IndusInd Bank led the pack on the Nifty.

Top Losers: ONGC, Bharti Airtel, Adani Enterprises, Cipla, and Apollo Hospitals were the laggards in today's session.

Hindustan Zinc: The board approved a second interim dividend of ₹19 per share.

Manjushree Technopack: Filed for a ₹30 billion India IPO.

Sequent Scientific: Received prequalification approval from WHO for Albendazole.

IndusInd Bank: Shares jumped 2% after RBI approved its entry into the mutual fund business.

Hi-Tech Pipes: Announced plans to raise up to ₹600 crore.

Poly Medicure: Opened its QIP, setting the floor price at ₹1,880.69 per share.

Cipla: Shares slipped nearly 1% following a penalty of ₹5.95 crore imposed by the Customs Authority.

Granules India: Secured ANDA approval for Glycopyrrolate Oral.

Optiemus Electronics: Entered the telecom equipment manufacturing sector.

TCS: Launched Pace Studio in Stockholm, expanding its innovation footprint in the Nordic region.

Stocks to Focus On:

Nucleus Software board announced plans to consider a buyback, signaling strong confidence in the company's future prospects.

Summary:

"With the Nifty closing near the 24,700 mark, the market outlook remains cautiously optimistic. As we move forward, investors will closely monitor global developments and sector-specific earnings to gauge the market’s direction."

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The information provided in this newsletter is for informational purposes only and should not be considered financial advice.

Follow us on Social Media