- The Stock whisperer's Newsletter

- Posts

- Daily Market Wrap-Up by Stock Whisperers: 12-AUGUST-2024

Daily Market Wrap-Up by Stock Whisperers: 12-AUGUST-2024

Amid Hindenburg flop show Indices End Flat in a Volatile Session

Market Overview:

Summary of the Day's Market Performance

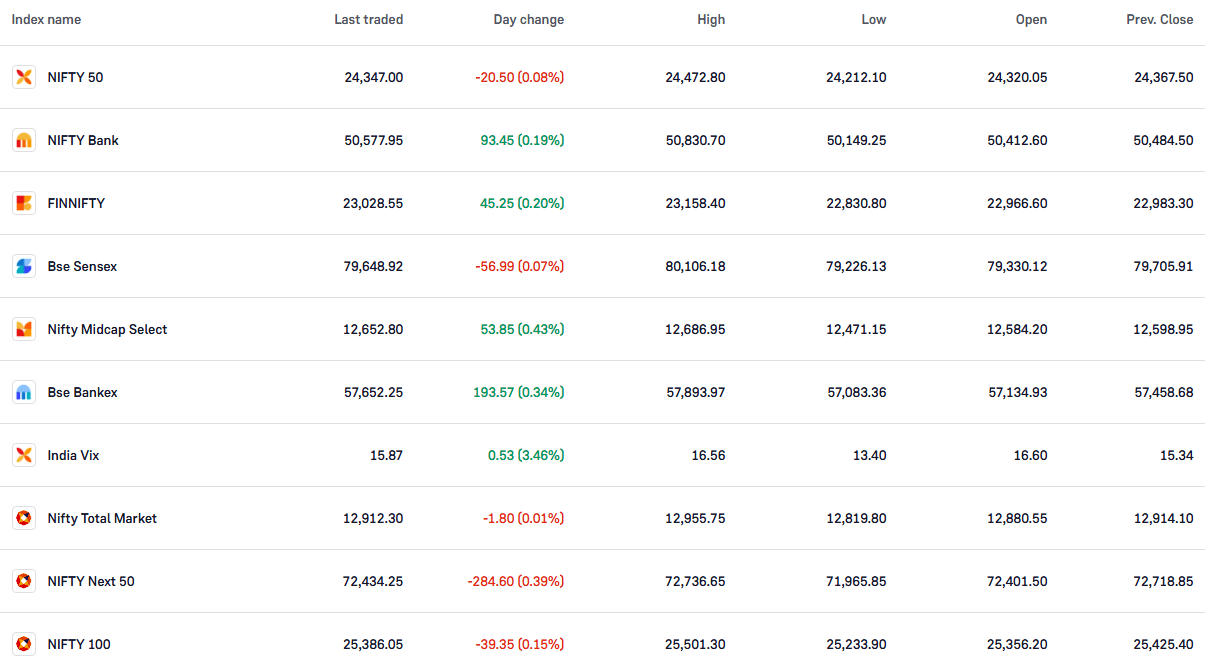

Nifty and Sensex ended on a flat note in a highly volatile session on August 12.

Sensex was down 56.99 points or 0.07% at 79,648.92, while Nifty declined by 20.50 points or 0.08% to close at 24,347.00.

The BSE Midcap index ended flat, while the Smallcap index managed to gain 0.5%.

Sector Highlights:

Performance of Key Sectors

Top Sector Gainers:

Banking, Telecom, IT, Oil & Gas, Metal, and Realty sectors saw moderate gains of 0.3-1%.

Top Sector Losers:

FMCG, Power, PSU Bank, and Media sectors were down 0.5-2%.

Market Transactions:

• 📉FII Sold: -4,680.51 cr.

• 📈DII Bought: 4,477.73 cr.

Hindenburg Report:

The latest Hindenburg report alleges that SEBI chief Madhabi Puri Buch and her husband held interests in offshore funds linked to the Adani Group. The Buchs clarified that their investments were made in 2015, before Madhabi's appointment as a SEBI director, and were influenced by Dhaval's longtime friend, Anil Ahuja.

Unlike the January 2023 report that caused a market sell-off, this time, the impact is expected to be minimal.

Important Observations and Market Sentiments:

"Despite the flat close, certain sectors and stocks continue to show strength, reflecting selective investor confidence. However, the market remains cautious amidst global and domestic developments."

Stock News:

Key Stock Movements and News

Nifty Gainers: Hero MotoCorp, Axis Bank, ONGC, Infosys, JSW Steel.

Nifty Losers: NTPC, Britannia Industries, Adani Ports, SBI, Dr. Reddy's Labs.

RVNL, Ircon & Railway PSU Stocks: Surge up to 8% on cabinet approval for ₹24,657 crore projects.

BHEL: Secured an order for the 2x800 MW Koderma Supercritical Thermal Power Project.

Kotak Mahindra Bank: Acquired 30 lakh equity shares of Open Network.

Inox Wind: Shares soared 20% following robust execution guidance and the best financial performance in Q1FY25, reporting a ₹50 crore net profit versus a ₹65 crore loss YoY.

Shipping Corporation: Profit zoomed 70% YoY to ₹291.5 crore, with revenue increasing by 26.2% to ₹1,514.3 crore.

Jubilant Foodworks: Shares rose 8% as Q1 profit doubled to ₹58.02 crore, and revenue jumped 44.8% YoY to ₹1,933.1 crore.

Bank of Baroda: Raised lending rates by 5 basis points on three-month, six-month, and one-year tenures, effective August 12.

Ola Electric: Locked in the upper circuit for the second consecutive day.

Coffee Day: Shares tanked 17% after NCLT ordered insolvency proceedings.

Stocks to Focus On:

Inox Wind: A strong Q1 performance makes it a stock to watch closely in the coming sessions.

Jubilant Foodworks: With significant profit growth, this stock is on the radar for further gains.

Summary:

"Today’s flat close amid volatility highlights the market's cautious stance. As the Hindenburg allegations are expected to have a limited impact, investors should keep an eye on earnings reports and sector performances for future direction."

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The information provided in this newsletter is for informational purposes only and should not be considered financial advice.

Follow us on Social Media 👇