- The Stock whisperer's Newsletter

- Posts

- 📈 Bulls Charge Ahead: Nifty Tops 25,100 as Liquidity Boost & Global Cues Fuel Rally!

📈 Bulls Charge Ahead: Nifty Tops 25,100 as Liquidity Boost & Global Cues Fuel Rally!

📰Daily Market Wrap-Up by Stock Whisperers-09 June 2025

09-June-2025

📈 Market Overview:

Summary of the Day's Market Performance

Market Overview

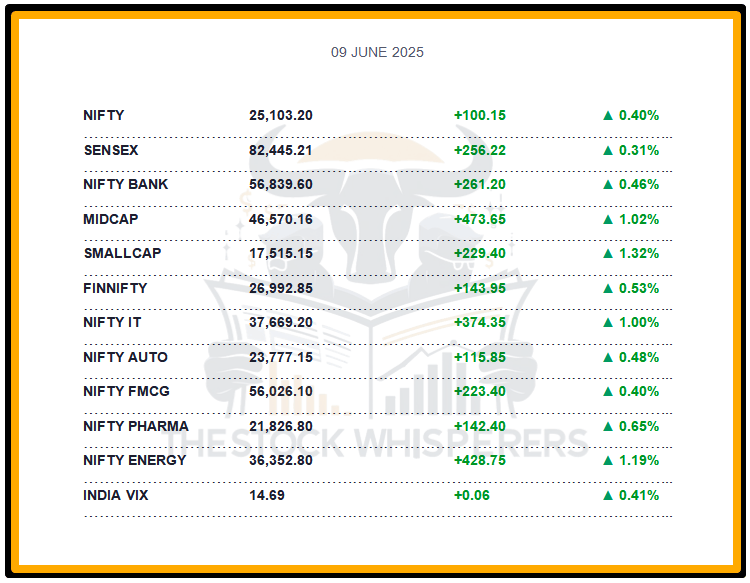

The Sensex gained 256.22 points (+0.31%) to close at 82,445.21, extending gains for the fourth day.

The Nifty rose 100.15 points (+0.40%) to 25,103.20, ending at 25,100.

Midcap and Smallcap indices added 1% each, reflecting strong broader market momentum.

IT, Oil & Gas, Power, and PSU Bank indices gained 1% each, while Realty was the only sector in the red.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹1,992.87 crore

Domestic Institutional Investors (DII): Bought ₹3,503.79 crore

Robust FII and DII inflows drove the rally, particularly in financial stocks.

📊📑 Important Observations and Market Sentiments: Editor Special

Financial stocks led the rally, fueled by the RBI’s aggressive policy of a 50 bps repo rate cut (to 5.75%) and 100 bps CRR cut (to 3.5%) on June 6, enhancing liquidity and boosting investor confidence, especially in Midcaps. Strong US jobs data (250,000 non-farm payrolls in May) and renewed optimism over US-China trade talks (post-tariff rollback) lifted global sentiment.

Domestically, large caps regained momentum, driven by FII inflows, while Midcaps and Smallcaps continued to outperform. Domestic macros remain supportive with a 7.2% Q4 GDP growth, better monsoon, and strong GST collections—bolstering a ‘buy-on-dip’ strategy.

Analysts expect Nifty to consolidate between 24,900–25,300, with support at 24,500—focus on financials and upcoming global trade developments.

❓ DO YOU KNOW?

The RBI’s CRR cut to 3.5% on June 6 released ₹1.5 lakh crore into the system, with 60% already reflected in bank lending growth as of today, per RBI data.

📰Stock News:

Key Stock Movements and News

Top Gainers: Bajaj Finance, Kotak Mahindra Bank, Axis Bank, Jio Financial, and Trent

Top Losers: ICICI Bank, Titan Company, M&M, Adani Ports, and Eternal

IIFL Finance surged 7.95%, leading Nifty 50 gainers, driven by strong Q4 FY25 results and NBFC sentiment post-RBI rate cut.

Bandhan Bank gained 7.23%, supported by the banking sector rally and Q4 earnings momentum.

Manappuram Finance rose 7.21%, reflecting strong NBFC demand after RBI’s policy easing.

MCX (Multi Commodity Exchange) climbed 6.97% on increased trading volumes and commodity market optimism.

Mahanagar Gas (MGL) gained 6.87%, driven by stable gas price trends and energy sector sentiment.

Jio Financial Services jumped 3.5% after Jio BlackRock Mutual Fund appointed its leadership and launched its website.

Suzlon Energy fell after promoters sold 20 crore shares via a block deal, impacting renewable sentiment.

Infosys gained as the DGGI closed pre-show-cause notices on a ₹32,403 crore GST demand for FY2018–2022.

Tata Steel was in focus after filing a petition in Delhi High Court for coal mine operations relief, with stable metal sentiment.

Goa Carbon dipped as its Goa unit announced a temporary shutdown for maintenance starting today.

Your Weekly Stock Markets Rundown:📊 RBI’s Bold Rate Cut Sets the Tone — Markets Eye Growth, Liquidity & Global Cues Ahead!

June 9- June 13, 2025

The week of June 9-13, 2025, begins on a high note after the RBI’s unexpected 50 bps rate cut, propelling the Sensex to 82,157.16 and the Nifty to 24,987.85. With liquidity set to improve via a phased CRR cut, domestic growth is prioritized, though global headwinds like geopolitical tensions persist. Investors will monitor key data releases, including US inflation, UK GDP, and India’s forex reserves, for directional cues. Rate-sensitive sectors like banking, real estate, and auto are poised for gains, while a stock-specific approach is advised amid potential mid-week volatility.

👀Stocks to Focus:

IIFL Finance: NBFC momentum post-rate cut to monitor.

Jio Financial Services: Mutual fund venture progress to watch.

Infosys: GST clarity impact to observe.

📝Summary:

Indian markets rose 0.4%, with Nifty at 25,103, marking a fourth straight gain, led by financials and FII inflows. IT, Oil & Gas, and PSU Banks gained, while Realty lagged. RBI’s policy easing and positive global cues (US jobs, trade talks) boosted sentiment—focus on financials and trade developments!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.