- The Stock whisperer's Newsletter

- Posts

- 📈 Bulls Charge Ahead! Nifty Reclaims 25,100 as Tensions Ease and Optimism Returns

📈 Bulls Charge Ahead! Nifty Reclaims 25,100 as Tensions Ease and Optimism Returns

📰Daily Market Wrap-Up by Stock Whisperers-20 June 2025

20-June-2025

📈 Market Overview:

Market Overview

Summary of the Day's Market Performance

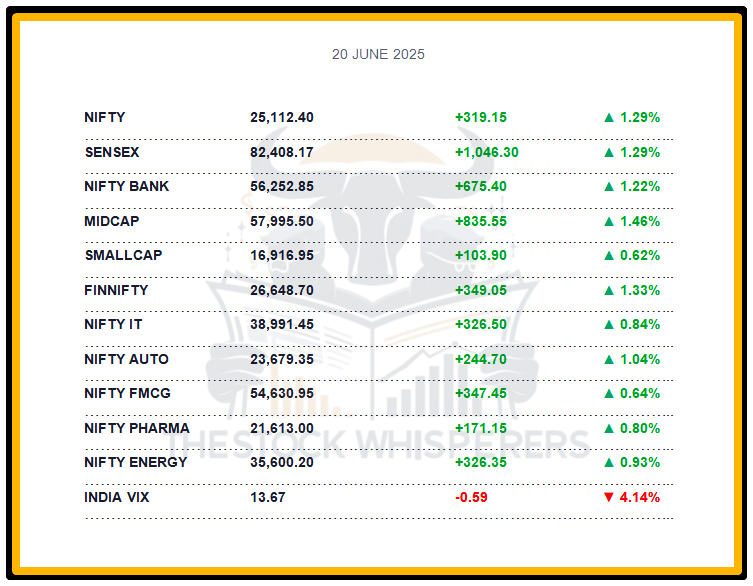

The Sensex gained 1,046.30 points (+1.29%) to close at 82,408.17, ending on a strong note.

The Nifty rose 319.15 points (+1.29%) to 25,112.40, reclaiming above 25,100.

Midcap index rose 1.4%, and Smallcap index gained 0.6%, reflecting broad market strength.

All sectoral indices ended in the green, with Metal, PSU Bank, Realty, Power, Telecom, and Capital Goods up 1-2%.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹7,940.70 crore

Domestic Institutional Investors (DII): Sold ₹3,049.88 crore

Robust FII inflows drove the rally, despite DII outflows.

📊📑 Important Observations and Market Sentiments: Editor Special

Markets surged as Middle East tensions eased, with reduced risk of immediate Israel-Iran military actions following expected US dialogue with Iran. Brent crude corrected to $76/barrel, boosting domestic sentiment and attracting FIIs. The VIX index dropped sharply, signaling lower volatility, while rate-sensitive and consumer-oriented sectors (Finance, Auto, Realty) gained on Q1 FY26 result anticipation, driven by rate cut benefits, lower inflation (May CPI at 3.8%), and rebounding consumer spending.

Analysts expect Nifty to consolidate between 24,900–25,300, with support at 24,500—focus on sustained Middle East de-escalation and Q1 earnings momentum.

❓ DO YOU KNOW?

Brent crude’s drop to $76/barrel today from a 2025 high of $78/barrel reflects a 2.5% correction, potentially saving India $0.5 billion in Q2 FY26 oil import costs if stable, per industry estimates.

📰Stock News:

Key Stock Movements and News

Top Gainers: Jio Financial, M&M, Bharti Airtel, Bharat Electronics, and Trent

Top Losers: Hero MotoCorp, Bajaj Auto, Maruti Suzuki, and Dr Reddy’s Laboratories

Nestle India gained over 2% after strong Q4 FY25 results, with its board set to consider a first-ever bonus share issue on June 26.

HDFC Bank rose on positive banking sentiment and anticipation of HDB Financial Services’ ₹12,500 crore IPO (June 25–27).

United Spirits gained after acquiring NAO Spirits for ₹130 crore, strengthening its craft gin portfolio.

Suzlon Energy rose 3% after securing a 170 MW wind order from AMPIN Energy, boosting renewables.

Sun TV Network dropped 5% before a slight recovery after DMK MP Dayanidhi Maran’s legal notice alleging fraud; the company denied the claims as baseless.

Adani Power gained as NCLT approved its resolution plan for Vidarbha Industries Power Limited.

Axiscades Technologies rose after partnering with Aldoria, a European space surveillance leader, to enhance India’s space security.

India Cements traded flat after India Cements Capital sold a 24.7% stake, impacting sentiment.

Your Weekly Stock Markets Rundown:🌍 Global Triggers, Cooling Inflation & RBI Liquidity Boost to Steer D-Street This Week

June 16-20, 2025

The week of June 16-20, 2025, brings a packed calendar with the G7 Summit, central bank rate decisions, and key economic data releases. India’s falling inflation at 2.8% in May supports a growth-friendly environment, though global uncertainties like US tariffs and oil market trends may drive volatility. The RBI’s June meeting minutes and bank credit data will clarify policy transmission, while corporate actions like Zee Entertainment’s fundraising and Arisinfra Solutions IPO add dynamism. Investors should focus on banking, energy, and real estate, adopting a stock-specific approach amid global and domestic developments.

👀Stocks to Focus:

Jio Financial: Telecom momentum to monitor.

Suzlon Energy: Renewable order impact to watch.

Nestle India: Bonus issue potential to observe.

📝Summary:

Indian markets rose 1.3%, with Nifty above 25,112, as Middle East tensions eased and crude fell to $76/barrel, boosting FII inflows. Metal and Realty led gains, while Auto lagged. Markets ended the week up 0.7%—focus on Q1 results and global stability!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.