- The Stock whisperer's Newsletter

- Posts

- 🔥 Bulls Bounce Back! Nifty Reclaims 24,300 as Markets Shake Off Geo-Tensions 📈✨

🔥 Bulls Bounce Back! Nifty Reclaims 24,300 as Markets Shake Off Geo-Tensions 📈✨

📰Daily Market Wrap-Up by Stock Whisperers-April 28

28-April-2025

📈 Market Overview:

Summary of the Day's Market Performance

Market Overview

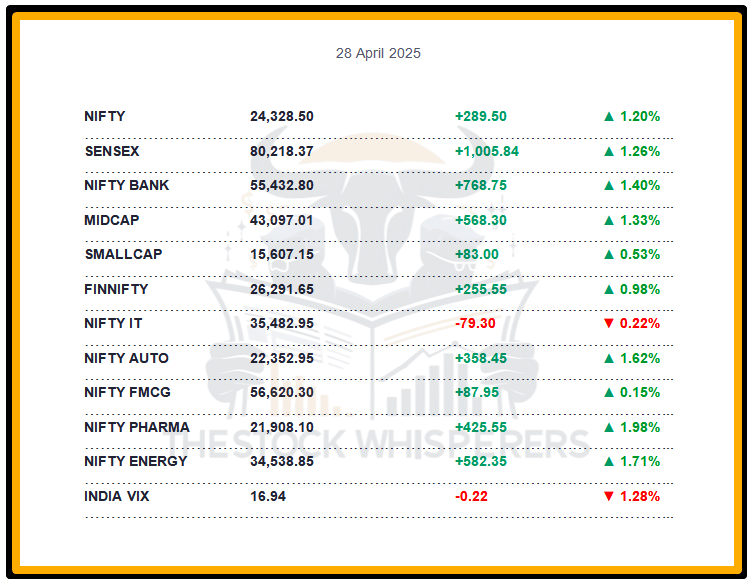

The Sensex rose 1,005.84 points (+1.27%) to close at 80,218.37 in a strong recovery.

The Nifty gained 289.15 points (+1.20%) to 24,328.50, reclaiming 24,300.

Midcap index rose 1.3%, while Smallcap index added 0.5%, showing broad-based gains.

All sectors ended in the green except IT.

💸 Market Transactions:

Foreign Institutional Investors (FII): Bought ₹2,474.10 crore

Domestic Institutional Investors (DII): Bought ₹2,817.64 crore

Sustained FII and DII buying drove the rally, reversing last week’s losses.

📊📑 Important Observations and Market Sentiments: Editor Special

The market rebounded from last week’s border tension-driven losses (Pahalgam attack fallout), fueled by strong FII inflows and robust Q4 results from Reliance Industries. A weakening US dollar and inflationary pressure in the US may continue attracting foreign funds.

Investors are cautious due to potential retaliation risks post-terror attack, with a 40% cash/debt allocation advised for new investors, focusing on bottom-up equity picks based on earnings.

Domestic sentiment is supported by the RBI’s accommodative stance (6.00% repo rate) and low inflation (March CPI at a 5-year low), though IT lagged amid profit-taking.

❓ DO YOU KNOW?

Reliance Industries’ Q4 FY25 New Energy milestone marks its first 100 MW solar project commissioning, boosting its renewable portfolio to over 1 GW.

📰Stock News:

Key Stock Movements and News

Top Gainers: Reliance Industries, SBI Life, Bharat Electronics, Sun Pharma, and JSW Steel

Top Losers: Shriram Finance, HCL Technologies, Eicher, UltraTech Cement, and HUL

Reliance Industries surged on strong Q4 FY25 results, with Reliance Retail’s growth, resilient Jio, and a New Energy milestone; Nomura, JP Morgan, and Morgan Stanley raised targets.

Mahindra & Mahindra gained after acquiring a 58.96% stake in SML Isuzu for ₹555 crore, with Ather Energy’s IPO opening today.

ICICI Bank rose as Motilal Oswal’s top pick, backed by an 18% YoY Q4 profit surge and an 11% NII rise.

ICICI Securities recommended Hindustan Aeronautics Ltd (HAL) (buy range ₹4,140–4,240, target ₹4,698), driven by defense sector optimism.

360 One WAM was Motilal Oswal’s other top pick, reflecting wealth management strength.

Patel Engineering gained focus after a ₹2,036 crore project win, listed for intraday trading by Vaishali Parekh.

Bandhan Bank and Sona BLW Precision Forgings were Vaishali Parekh’s intraday picks, leveraging banking and auto demand.

Restaurant Brands Asia and Shree Renuka Sugars were Sumeet Bagadia’s top stocks under ₹100 for intraday potential.

Power Finance Corporation remained under watch after a 3% drop due to ₹307 crore dues from Gensol Engineering.

Your Weekly Stock Markets Rundown: 🌪️ After the Storm: Markets Hold Breath Amid Geo Tensions, Global Rally Lifts Hopes! 📈🌏April 28- May 2, 2025

The week of April 28-May 2, 2025, begins with India’s market cautious after a dip triggered by India-Pakistan tensions, though US-China tariff de-escalation offers a silver lining with continued FII buying. Muted Q4 earnings temper optimism, but Nifty’s bullish stance above 24,000 suggests dip-buying potential. Key data like India’s manufacturing PMI, US jobless claims, and Euro Area GDP will guide sentiment, alongside Ather Energy’s IPO debut. Opportunities lie in IT, banking, and industrial stocks, with global cues and geopolitical developments in focus.

👀Stocks to Focus:

Reliance Industries: Q4 strength may sustain gains.

HAL: Defense sector momentum to monitor.

ICICI Bank: Banking resilience to watch.

📝Summary:

Indian markets rose 1.2%, with Nifty at 24,300, recovering from last week’s geopolitical losses on FII buying and Reliance’s Q4 results. All sectors gained except IT, with Midcaps leading. Caution persists due to border tensions—focus on earnings and trade developments!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.