- The Stock whisperer's Newsletter

- Posts

- 🏦 Bulls Bounce Back: Nifty Nears 25K as IT & Oil Stocks Shine Amid Global Tensions

🏦 Bulls Bounce Back: Nifty Nears 25K as IT & Oil Stocks Shine Amid Global Tensions

📰Daily Market Wrap-Up by Stock Whisperers-16 June 2025

16-June-2025

📈 Market Overview:

Market Overview

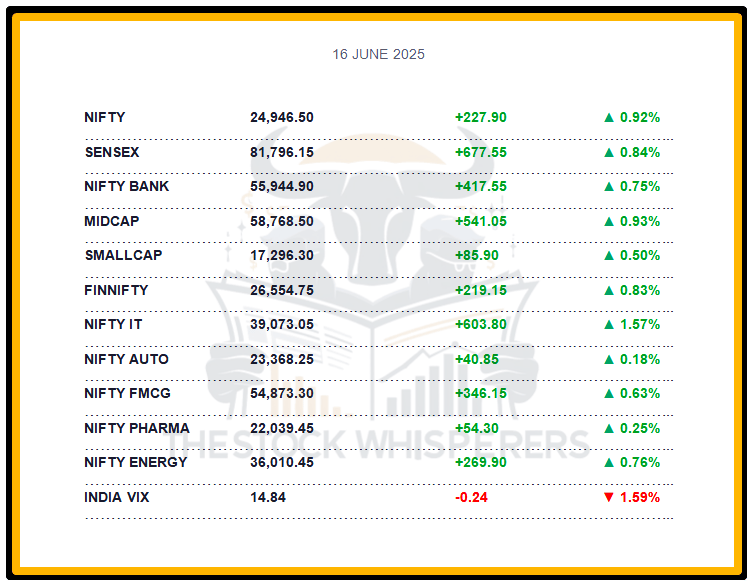

Summary of the Day's Market Performance

The Sensex gained 677.55 points (+0.84%) to close at 81,796.15, ending on a strong note.

The Nifty rose 227.90 points (+0.92%) to 24,946.50, reaching 24,950.

Midcap index added 0.9%, and Smallcap index rose 0.5%, reflecting broader market gains.

All sectoral indices ended in the green, with IT, Metal, Realty, and Oil & Gas up 1% each.

💸 Market Transactions:

Foreign Institutional Investors (FII): Sold ₹2,539.42 crore

Domestic Institutional Investors (DII): Bought ₹5,780.96 crore

Strong DII buying supported the rally, offsetting FII outflows.

📊📑 Important Observations and Market Sentiments: Editor Special

Despite ongoing Israel-Iran tensions, markets rose, driven by large-cap strength as investors focused on long-term fundamentals amid volatility. Geopolitical developments in the Middle East remain a near-term concern, with de-escalation cues closely watched—Brent crude eased slightly to $75/barrel today.

Smallcaps may underperform short-term due to elevated valuations and lack of triggers. IT outperformed ahead of the US Fed policy meeting (expected this week), which may clarify interest rate outlooks, while Oil & Gas gained despite geopolitical risks. Analysts expect Nifty to consolidate between 24,500–25,000, with support at 24,300—focus on Fed policy and Middle East updates.

❓ DO YOU KNOW?

The US Fed meeting, starting today, is widely expected to cut rates by 25 bps to 4.25-4.50%, per market consensus, potentially boosting IT sector sentiment further if confirmed.

📰Stock News:

Key Stock Movements and News

Top Gainers: SBI Life Insurance, UltraTech Cement, Bharat Electronics, HDFC Life, and ONGC

Top Losers: Tata Motors, Dr Reddy’s Laboratories, Adani Ports, and Sun Pharma

Bajaj Finance jumped 2.5% to ₹957.30 intraday, trading ex-split (1:2) and ex-bonus (4:1), though investors saw a momentary 90% demat value drop due to adjustments.

ITC gained after acquiring Sresta Bioproducts for ₹400 crore, boosting FMCG sentiment.

Yes Bank rose as Moody’s upgraded its ratings to Ba2, reflecting an improved banking outlook.

Tata Motors fell, dragging indices, despite Moody’s raising Jaguar Land Rover’s rating, amid weak auto sentiment.

Arkade Developers gained after entering the Thane metro market, boosting real estate sentiment.

JBM Auto rose after launching its ECOLIFE electric city bus at the UITP Summit 2025 in Hamburg.

Tata Consultancy Services (TCS) gained on a strategic partnership with Denmark’s Salling Group for digital transformation and AI-enabled cloud migration.

Patil Automation SME IPO opened today, receiving a muted 35% subscription, impacting SME sentiment.

Your Weekly Stock Markets Rundown:🌍 Global Triggers, Cooling Inflation & RBI Liquidity Boost to Steer D-Street This Week

June 16-20, 2025

The week of June 16-20, 2025, brings a packed calendar with the G7 Summit, central bank rate decisions, and key economic data releases. India’s falling inflation at 2.8% in May supports a growth-friendly environment, though global uncertainties like US tariffs and oil market trends may drive volatility. The RBI’s June meeting minutes and bank credit data will clarify policy transmission, while corporate actions like Zee Entertainment’s fundraising and Arisinfra Solutions IPO add dynamism. Investors should focus on banking, energy, and real estate, adopting a stock-specific approach amid global and domestic developments.

👀Stocks to Focus:

Bajaj Finance: Post-split and bonus momentum to monitor.

TCS: Digital transformation deal impact to watch.

Tata Motors: Auto sector weakness to observe.

📝Summary:

Indian markets rose 0.9%, with Nifty at 24,950, led by large-caps despite Israel-Iran tensions. IT and Oil & Gas gained, supported by DII buying and Fed policy anticipation. Smallcaps may lag due to valuations—focus on Fed outcome and Middle East de-escalation for direction!

😊Thank you for subscribing to our Market Wrap-Up. Stay tuned for tomorrow's update.

Disclaimer: The Stock Whisperers is a media platform providing educational and informational content related to the stock market. We do not offer investment advice, stock recommendations, or tips. Readers should consult a SEBI-registered advisor before making any investment decisions.